Advertisement|Remove ads.

MRVL Stock Shot Up 10% Pre-Market Today: What’s The SoftBank Angle?

- SoftBank Group Corp. reportedly explored acquiring Marvell earlier in 2025.

- Discussions took place months ago but failed to yield a consensus.

- Marvell creates and builds computer chips and other technologies used in data centers.

Marvell Technology Inc. (MRVL) stock rose over 10% in Thursday’s premarket after a report suggested SoftBank Group Corp. explored acquiring the tech company earlier in 2025.

According to a Bloomberg report, if the proposal had gone through, it could have been the semiconductor industry’s largest-ever deal.

AI Ambitions

The report stated that SoftBank’s billionaire founder, Masayoshi Son, had examined Marvell as a potential target multiple times in recent years. Talks between the two companies took place months ago but failed to yield an agreement.

The Japanese investment firm considered merging Marvell with its majority-owned chip designer, Arm Holdings Plc. (ARM), to strengthen its AI infrastructure portfolio.

What Are Stocktwits Users Saying?

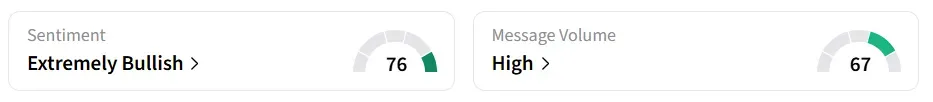

On Stocktwits, retail sentiment around Marvell stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day, with the message volume remaining in ‘high’ levels in 24 hours.

A bullish user proposed $150 as a fair buyout offer.

Another user regretted reducing his position to 30,000 shares from 50,000 shares before the report was released.

Marvell’s Operations

Marvell creates and builds computer chips and other technologies used in data centers, the large facilities that run cloud services and support artificial intelligence systems.

The company is scheduled to report its third-quarter (Q3) earnings on December 2 and expects revenue of $2.060 billion ± 5% and an adjusted earnings per share (EPS) of $0.74 ± $0.05 per share. Analysts expect a revenue of $2.06 billion and EPS of $0.74, according to Fiscal AI data.

Marvell stock has lost over 15% year-to-date and gained over 2% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)