Advertisement|Remove ads.

Microsoft Reclaims Top Market Cap Crown From Apple, But BofA Snubs Stock In 'Best Ideas' List: Retail Remains Unmoved

Microsoft Corp. (MSFT) has regained the crown of the most valuable global company from Apple, Inc. (AAPL). The iPhone maker's China exposure triggered a more significant decline and increased investor anxiety amid steep U.S. import tariffs.

Following Tuesday's close, Microsoft had a market capitalization of $2.636 trillion compared to Apple's $2.59 trillion and Nvidia Corp.'s (NVDA) $2.35 trillion.

Despite the feat, BofA Securities removed Microsoft from its "U.S. 1 List" - a group comprising the firm's best investment ideas out of its 'Buy’-rated stocks across sectors, The Fly reported.

The brokerage, however, retained Boston Scientific Corp. (BSX) and Spotify Technology S.A. (SPOT) in the list.

Microsoft was riding high on its credentials as the forerunner in the artificial intelligence (AI) race. Before the tariff sell-off started, the stock came under selling pressure amid reports that it is scaling back its AI investments.

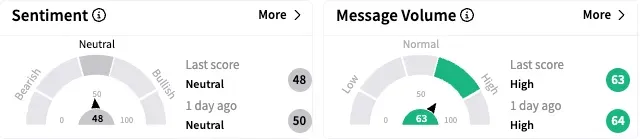

On Stocktwits, retail sentiment toward Microsoft stock remained 'neutral' (49/100), but the message volume on the stream stayed 'high.'

A bullish watcher said they were positive on the Magnificent Seven stocks, including Microsoft. Given the intensity of the tariff sell-off, the user expects a "V"-shaped recovery.

On the other hand, a bearish user braced for a move below $300 for Microsoft stock.

Microsoft stock ended Tuesday's session down 0.92% at $354.56, taking its year-to-date losses to over 15%. The Koyfin-compiled consensus price target for the stock is $501.90, implying a 42% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931078_jpg_7ccfff654b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)