Advertisement|Remove ads.

MicroStrategy’s Bitcoin Holdings Drive Historic High: Retail Unfazed

Shares of MicroStrategy Inc. ($MSTR), the largest corporate holder of Bitcoin($BTC.X), jumped by over 5% to reach an all-time high of $249.75 as markets opened on Monday.

The Michael Saylor-led corporation currently holds 252,220 Bitcoin valued at $17.38 million, driving its market capitalization to a 25-year peak of $49.9 billion.

Wall Street is bullish on the stock with all analysts giving the company buy-equivalent ratings, according to Finchat data.

Analysts note that the company's strategy of purchasing Bitcoin to safeguard the value of its reserve assets has bolstered the stock's appeal, which closely tracks the digital asset’s movements. The consensus price target is set at $215, with Bernstein providing the highest target of $290.

In a recent research note, BTIG stated, “MicroStrategy continues to be the premier vehicle for Bitcoin exposure via the public equity market, and the more Bitcoin it can acquire only helps valuation.”

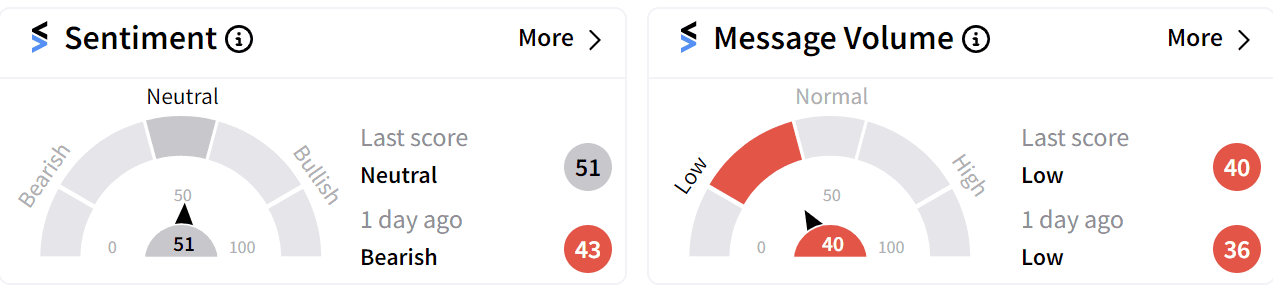

Retail sentiment on Stocktwits edged into the ‘neutral’ territory (51/100) from ‘bearish’ but chatter continues to be in the ‘low’ region.

MicroStrategy began its Bitcoin acquisition strategy in 2020 as revenue from its software business declined, positioning itself as the largest corporate holder of the cryptocurrency. The company now controls 1.2% of Bitcoin's total supply, capped at 21 million.

Recent capital raises have provided the company with over $1 billion in funds. If MicroStrategy uses this capital to purchase more Bitcoin, it could become the fifth-largest holder of the cryptocurrency globally, trailing only BlackRock($BLK), Binance($BNB.X), Satoshi Nakamoto, and Coinbase ($COIN), according to CoinDesk.

Other tech companies have also taken note. Microsoft Corp. ($MSFT), with a market capitalization exceeding $3 trillion, disclosed plans to vote on an “Assessment of Investing in Bitcoin” at its upcoming shareholders meeting in December. A filing with the SEC revealed that shareholders had requested this assessment, citing Bitcoin's impressive gains — nearly 100% over the past year and 414% over the last five years.

The proposal highlighted MicroStrategy as a prominent technology company that holds a significant amount of Bitcoin on its balance sheet and whose shares have outperformed Microsoft in 2024.

While Microsoft shares have gained 16% so far in 2024, MicroStrategy shares have shot up a whopping 263%.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alibaba_jpg_4d8d9521c8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)