Advertisement|Remove ads.

Nasdaq Futures Fall, Pointing To Another Rough Day For Techs, But Strategist Plays Down Late-Week Weakness

- Tech once again led the market sell-off on Thursday, as AI fears continued to dominate.

- Gold futures have pulled back amid reduced odds of a Fed rate cut.

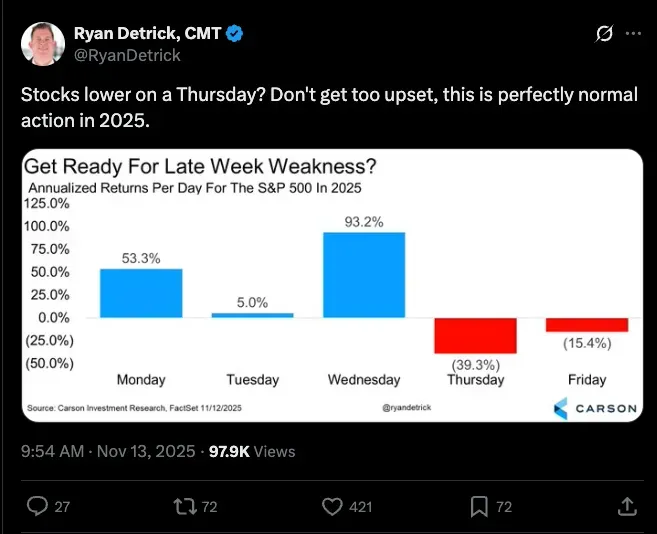

- Carson Group’s Ryan Detrick shrugged off Thursday’s slump as aligning with the trading pattern in 2025.

The index futures traded lower early Friday, with the negativity carrying over from the previous session. Volatility has been the hallmark of trading this week as fears of an artificial intelligence (AI) bubble intensified and hopes for a rate cut waned. The negative sentiment generated by the adverse catalysts outweighed the positive mood set in motion by the end of a record 42-day-long government shutdown.

The markets will receive more guidance on the December rate decision as two hawkish Fed officials are scheduled to speak during the trading session.

How Futures Are Trading

As of 3:20 a.m. ET on Friday, the Nasdaq 100 futures slipped 0.50% and the S&P 500, Dow and Russell 2000 futures fell modestly.

On Stocktwits, retail sentiment toward the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the S&P 500 Index, and the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, tempered to ‘bullish’ as of early Friday from the ‘extremely bullish’ mood seen the day before. The message volume on the SPY and QQQ ETF streams was at ‘high’ levels.

Commenting on the QQQ stream, a bullish watcher slammed the market for selling off the “only sector worth anything right now.” “A stroke of genius!” they said sarcastically.

Another user pointed out that the SPY ETF and QQQ ETF were less than 4% off their highs. “These are not panic levels. Markets consolidate; Markets trade; Markets can be choppy. Backdrop is bullish, as are major trends,” they added.

How Markets Fared Thursday

Tech once again led the market sell-off on Thursday, as AI fears continued to dominate and rate fears returned with a vengeance. Fed officials, who spoke on Thursday, suggested that they preferred to wait and watch rather than jump the gun. Some of the weaknesses may also be attributed to the earnings catalyst and provisions of the stopgap funding bill that was signed into law by President Donald Trump.

The QQQ ETF plunged 2.04%, the iShares Russell 2000 ETF (IWM) dropped by 2.77%, while the SPY ETF and the SPDR Dow Jones Industrial Average ETF Trust (DIA) slipped 1.66% each.

Carson Group’s Ryan Detrick shrugged off Thursday’s slump as aligning with the trading pattern in 2025. Sharing a chart showing the S&P 500 generating negative annualized returns for Thursday and Friday, the strategist said, “Don't get too upset, this is perfectly normal action in 2025.”

The major indices are on track to close out the week on a negative note.

Key Catalysts To Watch Out For

Kansas City President Jeff Schmid is scheduled to speak at 10:05 p.m. ET, followed by Dallas Fed’s Lorie Logan at 2:30 p.m. ET.

Scholar Rock (SRRK) and Spire (SR) are among the companies due to release their quarterly results on Friday.

How Other Markets Fared

Crude oil futures built on the previous session’s advance and climbed by over 1% early Friday, but gold futures have pulled back amid reduced odds of a Fed rate cut. The 10-year-old U.S. Treasury note yield pushed further above the 4.1% level. The U.S. dollar is trading slightly firmer against its counterparts. Most major Asian markets retreated sharply, tracking the losses overnight on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_artificial_intelligence_jpg_7c39349f2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Crypto_com_dcfe1eaba6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)