Advertisement|Remove ads.

Nasdaq On Watch After Topping Q4 Profit Estimate: Retail’s Elated

Nasdaq Inc (NDAQ) shares gained retail attention Wednesday after the company’s fourth-quarter earnings topped Wall Street estimates.

On an adjusted basis, the firm reported net earnings of $0.76 per share for the fourth quarter, compared with a Wall Street estimate of $0.75 per share, according to FinChat data.

Its quarterly revenue rose 10% to $1.23 billion compared to last year and roughly aligned with Street estimates.

The company said its solutions revenue rose 10% year-over-year (YoY), reflecting strong growth from Index and Financial Technology.

Nasdaq has sought to diversify its portfolio beyond trading and has moved to bolster its product offerings related to compliance and cybersecurity.

Its fourth-quarter market services segment revenue grew 12%, bolstered by higher revenue from equity derivatives trading.

The company said its new quarterly listings rose to 162 from 100 the previous year.

Major initial public offerings at Nasdaq during the quarter included aerospace firm StandardAero Inc., autonomous vehicle operator WeRide, and software firm ServiceTitan.

Nasdaq said its 2025 adjusted operating expenses would be between $2.25 billion and $2.33 billion, compared with $2.16 billion in 2024.

The stock fell 1.7% in morning trade.

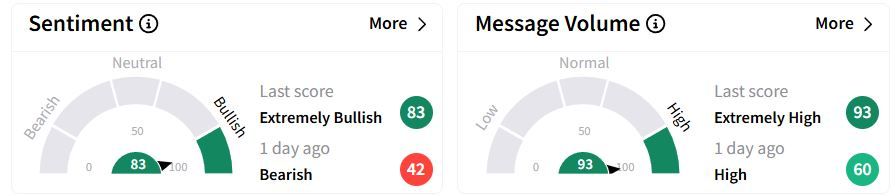

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (83/100) territory from ‘bearish’(42/100) a day ago and hit a year-high, while chatter jumped to ‘extremely high.’

The company had agreed to sell its Nordic power futures business to Euronext.

The stock has gained 18% over the past six months, while over the past 12 months, it has gained 36%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)