Advertisement|Remove ads.

NetEase Stock Rises On Strong Q1 Earnings, Retail Turns Bullish

NetEase Inc (NTES) shares traded 8.5% higher in Thursday’s premarket after the company reported better-than-expected first-quarter (Q1) earnings.

The Chinese gaming player reported a first-quarter FY25 revenue growth of 7.4% year-on-year (YOY) to RMB28.8 billion ($4 billion), beating the analyst consensus estimate of RMB28.4 billion, as per Finchat data.

Adjusted earnings per share (EPS) of RMB3.50 ($0.48) also beat the consensus estimate of RMB2.74. Adjusted earnings per American depository shares (EPADS) totaled $2.41.

Games and related value-added services revenue rose 12.1% to RMB24.0 billion ($3.3 billion). Revenues from the operation of online games accounted for approximately 97.5% of the segment’s net sales.

Youdao revenue declined 6.7% YOY to RMB1.3 billion ($178.9 million). NetEase Cloud Music revenue fell 8.4% YOY to RMB1.9 billion ($256.1 million).

Total operating expenses decreased 14.4% to RMB8.0 billion ($1.1 billion). The gross profit for the quarter increased 8.6% to RMB 18.5 billion ($2.5 billion). The company held $5.75 billion in cash and equivalents as of March 31. The quarter's operating net cash flow was $1.67 billion.

“We entered 2025 with solid momentum, fueled by our ongoing innovation and new titles that strengthen our reach across genres and resonate with players around the world,” said CEO William Ding.

NetEase, a company that earns a large share of its income from online gaming, cloud computing, and e-commerce, has been particularly exposed to challenges arising from trade tensions between the U.S. and China.

The company’s stock heaved a sigh of relief on Monday following an announcement from the U.S. and China that they had agreed to suspend the majority of tariffs for the next 90 days.

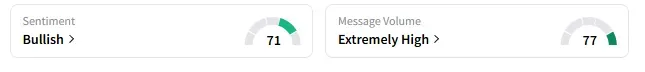

On Stocktwits, retail sentiment jumped to 'bullish' from ‘bearish’ the previous day.

NetEase stock added 20% in 2025 and 8.45% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)