Advertisement|Remove ads.

CoreWeave Retail Traders Eye Buying The Dip As Stock Slips Despite Q1 Revenue Beat, Positive Guidance

CoreWeave, Inc.'s (CRWV) maiden quarterly report as a public company failed to appease investors as they bid down the stock in Wednesday's after-hours session.

Livingston, New Jersey-based CoreWeave reported a net loss of $1.49 per share for the first quarter of the fiscal year 2026, wider than the $0.62 per share loss reported a year ago.

The net loss of $314.64 million included a $177 million stock-based compensation expense for awards with a liquidity-event performance-based vesting condition, which was satisfied at the initial public offering (IPO).

The adjusted loss per share was $0.61, which was more than the Koyfin-compiled consensus loss estimate of $0.12 per share.

CoreWeave, an operator of artificial intelligence (AI) data centers, reported revenue of $981.63 million, up 420% year over year (YoY) and exceeding the consensus estimate of $859.77 million.

Co-founder and CEO Michael Intrator said, "Our strong first quarter financial performance caps a string of milestones, including our IPO, our major strategic deal with OpenAI, as well as other customer wins, our acquisition of Weights & Biases, and many technical achievements."

The executive noted robust and accelerating demand for its platform, as AI leaders seek the highly performant AI cloud infrastructure required for the most advanced applications.

On the earnings call, Intrator said CoreWeave has added new enterprise customers and a new hyperscaler and signed expansion agreements with several large customers, including a recent $4 billion expansion with a large AI enterprise, according to a Koyfin transcript.

He also cautioned regarding the uncertainties caused by the ongoing volatility in the global trade policy environment.

Issuing the forward guidance on the call, CFO Nitin Agrawal said the company expects second-quarter revenue from $1.06 billion to $1.1 billion, and capex of $3 billion to $3.5 billion, reflecting accelerated platform investments to meet customer demand.

The company guided full-year revenue to $4.9 billion to $5.1 billion and capex to $20 billion-$23 billion.

The outlook exceeded the consensus revenue estimates of $988.48 million for the second quarter and $4.66 billion for the year.

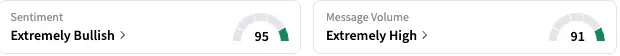

On Stocktwits, retail sentiment toward CoreWeave stock was 'extremely bullish' (95//100), and the message volume was 'extremely high.'

The stock was among the top five equity tickers trending on the platform and among the top 15 active equity tickers.

A bullish watcher called CoreWeave's guidance 'incredible,' adding that they would add to their position if the stock fell on Thursday.

Another user recommended that fellow retailers buy and hold the stock, expecting a short-squeeze rally that could push the stock to $75. Short interest in the stock, however, is 1.1%.

CoreWeave ended Wednesday's session up 6.64% at $67.46 but fell 7.89% after-hours. The stock has gained about 69% from its debut session's closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)