Advertisement|Remove ads.

Muted Monday For Indian Markets: Dabur, Godrej Consumer Rally On Strong Q1 Update, JP Power Soars 20%

Indian equity markets remained in a wait-and-watch mode on Monday, with the Nifty index closing below the 25,500 mark. Caution prevailed in a range-bound session as investors awaited developments on the US-India trade deal and looked for cues from the first-quarter earnings season, which kicks off this week.

The Sensex closed 9 points higher at 83,442, while the Nifty 50 ended flat at 25,461. Broader markets saw mild selling pressure, with the Nifty Midcap index closing 0.3% lower, while the Nifty Smallcap index fell 0.4%.

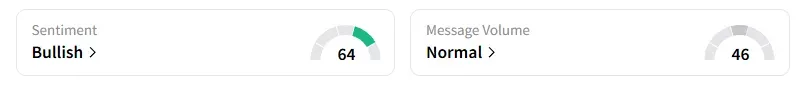

However, the retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, FMCG was the biggest gainer, rising 1.7%, followed by marginal gains in the oil and gas and realty sectors. On the other hand, media, metals, and IT stocks saw selling pressure.

Among FMCG stocks, Dabur (+3%) and Godrej Consumer (+6%) shares rallied as the street cheered their strong operational update for the first quarter (Q1 FY26). HUL was the top Nifty gainer, gaining 3%.

Meanwhile, Jubilant Foods and Info Edge fell 4% on a disappointing Q1 outlook.

Defense stocks continued to trend lower, led by BEL, which was the top Nifty loser (-3%). Other stocks, such as GRSE (-3%), Paras Defence (-5%), and Astra Micro (-4%), also ended lower. DCX Systems (+3%) bucked the trend on an order win.

Jaiprakash Power Ventures (JP Power) ended 20% higher following media reports that the Adani Group has emerged as the top bidder to acquire Jaiprakash Associates (JP Associates).

Globally, European markets traded mixed, while US stock futures indicate a positive start on Wall Street. Crude oil prices edged lower after OPEC+ output was boosted more than estimated.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)