Advertisement|Remove ads.

Nifty Reclaims 24,800, Smallcaps Shine As Markets Snap 3-Day Losing Streak; Tata Chemicals Surges On Upgrade

Indian equity markets snapped a three-session losing streak to end higher on Tuesday, with the Nifty index reclaiming the 24,800 level.

On Tuesday, the Sensex closed 446 points higher at 81,337, while the Nifty 50 ended 140 points higher at 24,821. Broader markets outperformed, with the Nifty Midcap index rising 0.8% and the Smallcap index gaining 1%.

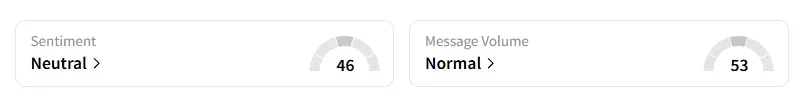

And the retail investor sentiment surrounding the Nifty 50 moved from ‘bearish’ to ‘neutral’ by market close on Stocktwits.

Stock Moves

Sectorally, all indices ended in the green, led by real estate (1.6%), pharma (1.3%), metals and energy (1%).

Jio Financial was the top Nifty gainer, ending 5% higher ahead of its board meeting tomorrow to discuss fundraising plans.

Asian Paints gained 2% following its June quarter (Q1 FY26) earnings report. Other earnings movers include Apar Industries (+12%), Paradeep Phosphates (+10%), Varun Beverages and Deepak Fertilizers (+6%).

On the flip side, Mazagon Dockyard and Home First Finance shares ended 4% lower on weak earnings.

Tata Chemicals shares surged 7% after Morgan Stanley upgraded the stock to ‘Overweight’ with a revised target price of ₹1,127. Meanwhile, IEX ended 3% lower after it received another brokerage downgrade. Bernstein reduced its rating to ‘Underperform’ and revised its target to ₹99, indicating a 29% downside.

Markets: What Next?

Analyst Shubham Jain suggested that this could be a good time to invest in the markets with a stop loss below the daily close of 24,450. His rationale behind this is that the market is expected to stay in an uptrend till a close below 24,500 as per the Dow theory.

Globally, European markets traded higher, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)