Advertisement|Remove ads.

Indian Markets End Higher Ahead Of RBI Rate Decision; Pharma, Real Estate Lead Gains

Indian equity markets closed higher on Thursday, ahead of the Reserve Bank of India’s monetary policy announcement due on Friday.

The central bank is widely expected to cut the repo rate by 25 basis points.

The Sensex ended 443 points higher to close at 81,442, while the Nifty 50 rose 130 points to finish at 24,750.

The broader markets outperformed, with the Nifty Midcap index gaining 0.6% and the Smallcap index ending nearly 1% higher.

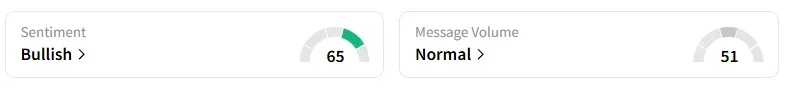

Retail investor sentiment surrounding the Nifty 50 remained ‘bullish.’

On the sectoral front, gains were led by real estate (+1.7%) and pharma (+1.2%) stocks, even as auto, PSU banks, private banks, and media stocks faced mild selling pressure.

The defense sector stood out, with Cochin Shipyard surging 12%, while Paras Defence and Data Patterns gained 6% each.

Eternal extended its rally and ended as the top Nifty gainer with a 4% rise.

Dr Reddy’s Laboratories rose 3% after the company announced a biosimilar partnership with Alvotech. HSBC upgraded the stock to ‘Buy’ and raised the target price to ₹1,445.

Hindustan Zinc surged 6% as silver prices hit a record high.

European markets traded higher ahead of the European Central Bank’s (ECB) interest rate decision, and Dow Futures indicated a weak opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)