Advertisement|Remove ads.

India Market Wrap: Nifty Holds 25,100 On Expiry Day; Tech Mahindra, LTIMindtree Lead IT Weakness

Indian equity markets ended lower on Thursday, with the Nifty index holding the 25,100 level in the expiry session.

The Sensex closed 375 points lower at 82,259, while the Nifty 50 ended 100 points lower at 25,111. Broader markets were also under pressure, with the Midcap and Smallcap indices falling 0.1%.

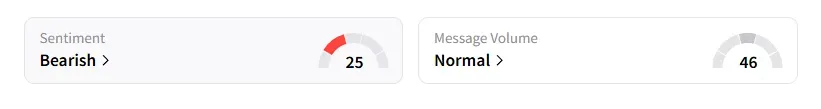

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Sectorally, real estate, metals, and pharmaceuticals performed well, while IT and financials remained under pressure.

Tech Mahindra was the top Nifty loser, ending nearly 3% lower as its first-quarter earnings failed to meet expectations. LTIMindtree ended 3% lower ahead of earnings.

Newgen shares declined 6% due to weak operational performance. Meanwhile, HDFC AMC ended over 2% higher after its profits rose 24% to ₹748 crore.

Wipro and Axis Bank earnings came in after market closing hours. Wipro reported a muted quarter and sees revenue growth to be between -1% and +1% during the second quarter in constant currency terms.

Axis Bank's profit declined by 4% as provisions increased to ₹3,947 crore, and its asset quality deteriorated, with gross non-performing assets (NPAs) rising to 1.57%.

Patanjali continued its strong run, ending 1.6% higher after its board approved a 2:1 bonus share issue.

Bharti Airtel ended marginally lower. The company has partnered with Perplexity to offer its customers a complimentary one-year annual subscription to Perplexity Pro. Analyst Sunil Kotak expects a retracement around its 50-day Simple Moving Average (SMA), with strong demand around ₹1,900-₹1,930, with resistance at ₹2,050-₹2,080.

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street. Oil prices edged higher on signs of easing trade tensions.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)