Advertisement|Remove ads.

India Market Wrap: Nifty, Sensex End Lower, Dragged By Global Jitters

Indian equity markets ended lower on Thursday, weighed down by a sharp global sell-off and rising U.S. bond yields.

Renewed concerns around America’s fiscal health dampened sentiment, sparking risk-off trades across most sectors.

The Nifty 50 fell 203 points to close at 24,609, while the Sensex lost 644 points to settle at 80,951.

The broader market outperformed slightly, with the Nifty Midcap 100 slipping just 0.5%.

Sector-wise, the mood was predominantly negative. All major indices ended in the red, barring media. Losses were led by FMCG, IT, oil & gas, and auto stocks.

IT stocks dragged the market, amid fears that U.S. fiscal instability could impact global tech spending. Wipro slipped 2%, while Tech Mahindra, TCS, and Infosys each lost nearly 2%.

In contrast, IndusInd Bank defied the market mood, surging 2% to become the top Nifty gainer despite reporting a larger-than-expected quarterly loss.

During its post-earnings call, management assured that all key issues had been addressed and that a new CEO would likely be announced by June 30.

Fortis Healthcare climbed 7%, driven by upbeat FY26 guidance that projected 14% to 15% revenue growth, which cheered investors.

ONGC led the Nifty losers, falling 3% after the state-owned energy major reported a 35% year-on-year decline in consolidated net profit to ₹6,448 crore for the March quarter.

Colgate-Palmolive also took a hit, plunging over 6% after reporting weaker-than-expected earnings.

Garden Reach Shipbuilders & Engineers (GRSE) jumped 10% after emerging as the lowest bidder for defense projects estimated at ₹25,000 crore.

BSE shares dropped 4% as reports hinted that the market regulator may approve a Tuesday expiry for NSE.

Meanwhile, Sun Pharma (-0.5%) and ITC (-1.7%) ended lower ahead of their Q4 results, which are due post-market.

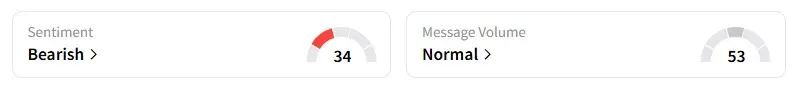

Retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Globally, European markets traded lower, while U.S. futures signaled a muted open, as investors remained cautious due to elevated Treasury yields.

Oil prices also softened, following a report that OPEC+ may increase production from July, coupled with an unexpected buildup in U.S. crude inventories.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)