Advertisement|Remove ads.

Nifty Opens Above 25,200 As Realty, FMCG Stocks Lead Early Gains; Tech Mahindra Slips Post Q2

Indian equity markets opened on a positive note, with the Nifty moving past the 25,200 mark. Barring media, all sectors traded in the green at opening, with real estate and FMCG leading the gains.

At 09:40 a.m. IST, the Nifty 50 traded 107 points higher at 25,252, while the Sensex was up 232 points at 82,262. Broader markets mirrored the optimism, with the Nifty Midcap index rising 0.7%, and the Smallcap index gaining 0.3%.

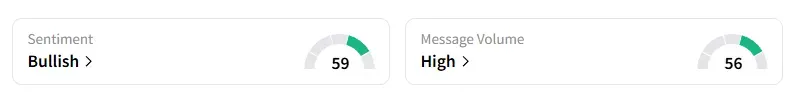

The retail sentiment on Stocktwits for the Nifty was ‘bullish’ at market open amid ‘high’ message volumes.

Stock Watch

Tech Mahindra was the top Nifty loser, falling over 1% after its Q2 profits missed street estimates. Axis Bank too remained under pressure ahead of its earnings report later today.

On the other hand, Thyrocare, ICICI Lombard, and Persistent rallied 6% following a strong show in the September quarter earnings.

Mishra Dhatu Nigam shares rose 1% on securing an order worth ₹306 crore.

Godrej Properties rose nearly 3% on acquiring a 26-acre land parcel near Sarjapur Road, Bengaluru, with revenue potential of ₹1,000 crore.

LT Foods rose 2% on plans to acquire Hungary-based Global Green Europe for €25 million.

And gold surging to record highs sparked over 1% gains in gold loan companies such as Muthoot and Manappuram Finance.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Wednesday with a 1-week timeframe:

SKF India: Buy at ₹5,008, with a target price of ₹5,200, and stop loss at ₹4,910

Schloss Bangalore (Leela): Buy at ₹438, with a target price of ₹446, and stop loss at ₹434

Cyient DLM: Buy at ₹468, with a target price of ₹476, and stop loss at ₹462

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Investment advisor Nidhi Saxena of The Trade Bond noted that Nifty continues to trade in a narrow range of 25,000–25,300. A sustained move above 25,300 could trigger short covering, while 25,000 remains a key support level for the index.

For Nifty Bank, she added that the underlying trend remains positive with immediate support placed at 56,200 on an hourly closing basis. A move above 56,770 is likely to trigger short-term momentum and extend the upmove.

Global Cues

Globally, Asian markets traded mostly higher, while crude oil prices held firm after falling to a five-month low.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)