Advertisement|Remove ads.

Nifty Hovers Near 25,100 In Rangebound Trade; Tata Motors Gains, Paytm Slips

Indian equity markets opened marginally higher, tracking positive global cues after the US announced trade deals with Japan, Philippines and Indonesia. The Nifty index hovers around the 25,100 level.

At 09:40 a.m. IST, the Nifty 50 traded 44 points higher at 25,104, while the Sensex was up 133 points at 82,320. Broader markets underperformed, with the Nifty Midcap index declining 0.1% and the Smallcap index falling 0.3%.

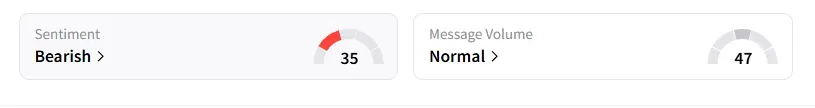

Meanwhile, the retail sentiment on Stocktwits for Nifty remained ‘bearish’.

Sectorally, it’s a mixed bag, with real estate (-2.5%), media (-1.2%) seeing big losses, while auto saw gains of 1%.

Paytm shares fell over 2% despite reporting net profit of ₹123 crore against net loss of ₹839 crore a year ago. Other earnings movers include JSW Infrastructure, Dixon Technologies that rose 2% driven by steady June quarter earnings performance.

Tata Motors is the top Nifty gainer, rising 3% ahead of India-UK free trade agreement deal signing on Thursday during Prime Minister Narendra Modi's UK visit.

Siemens Energy fell nearly 3% after a Russian arbitration court ordered them to pay ₹443.76 million, plus 8% interest. This ruling follows the annulment of a supply contract and related advance payments.

Kirloskar Ferrous rose 5% on being declared the preferred bidder for the Jambunatha iron ore mine in the auction held in January. Meanwhile, Oberoi Realty fell over 3% following a large block deal.

Watch out for Infosys, Dr Reddy's Laboratories, Tata Consumer Products, Coforge, Persistent Systems, SRF, Syngene, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that if the Nifty index manages to close above 25,110 on a 15-minute timeframe, it could take the index to 25,180 or higher levels. On the downside, immediate support is seen near 25,020, and a break below this level can drag the index into a range of 24,920 - 25,110. Options Implied Volatility has crashed to historical lows, he added.

Prabhat Mittal pegged Nifty support at 25,000 and resistance at 25,200. For the Bank Nifty, he sees support at 57,100 and resistance at 56,400.

Prameela Balakkala pegged support at 24,900 and resistance between 25,200 and 25,260. Her bias remains sideways to bullish in the short term. If the index holds above 24,900, it could trigger a bounce, especially if earnings deliver a surprise. The Relative Strength Index at 46.83 signals neutral momentum. She added that with price action near demand zones and recent structure shifts, traders must watch for signs of a reversal if buyers step in at support.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) have sold over ₹3,500 crore worth of equities in the cash market. At the same time, they have built fresh net index short positions in the F&O segment, particularly in Nifty, which is a signal of cautious positioning ahead of expiry. Also, quarterly earnings so far have been below market expectations, and this is likely to keep the market in a range-bound mode until expiry, according to him.

Patel also highlighted that in August, MSCI will announce its index rebalancing. Given the sharp rally in Chinese markets, India's weightage may be reduced, which could explain the recent FII outflows. A lower weightage would lead to passive fund outflows from Indian equities.

Their stance remains cautious, advising traders to select high-quality stocks with strong fundamentals and adhere to disciplined risk management, including tight stop-losses.

Globally, sentiment has turned positive following the US' signing of trade agreements with more countries. Asian markets traded higher, while crude oil prices declined for a third consecutive session.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)