Advertisement|Remove ads.

India Markets Muted Ahead Of Expiry, All Eyes On TCS Earnings; SEBI RAs Eye 25,600 As Key Nifty Resistance

Indian equity markets remained range-bound on Thursday, ahead of the weekly expiry session, with the Nifty index hovering around the 25,400 level.

At 09:40 a.m. IST, the Nifty 50 traded 32 points lower at 25,443, while the Sensex was down 109 points at 83,426. Broader markets outperformed with the Nifty Midcap index rising 0.1%, and the Smallcap index gaining 0.3%.

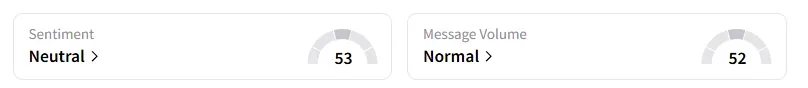

However, the retail sentiment on Stocktwits for Nifty was back to ‘neutral’ from ‘bullish’ a day ago.

Sectorally, healthcare and pharmaceutical stocks traded under pressure, while metals, banks, and oil and gas companies witnessed some buying.

The IT sector traded lower on Thursday as behemoth Tata Consultancy Services (TCS) prepares to announce its first-quarter earnings today. Analyst Sunil Kotak said results are expected to be muted, with reports estimating a sequential decline in profit and revenues, weighed down by the ramp-down in key deals.

Tata Elxsi, Indian Renewable Energy Dev Agency (IREDA), Anand Rathi are among the other companies reporting quarterly earnings on July 10.

Enviro Infra gained 4% after its joint venture secured a ₹395.5 crore order from Maharashtra Industrial Development Corporation.

Emcure Pharma rose 1% as the US FDA completed a pre-approval inspection of its Ahmedabad oncology facility with zero observations.

Orient Tech shares gained 2% after bagging a ₹29.86 crore order by Protean eGov Technologies. And Embassy REIT shares fell over 1% after a large block deal.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged Nifty support at 25,410 and resistance at 25,600. For the Bank Nifty, he sees support at 56,900 and resistance at 57,500.

A&Y Market Research sees Nifty intraday resistance between 25,648-25,662, with support at 25,308-25,322. For Bank Nifty, they pegged intraday resistance at 57,633-57,676, and support at 57,028-57,071.

Globally, Asian markets traded mixed, while crude oil prices gained marginally.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)