Advertisement|Remove ads.

Nio Stock Rises Premarket After CEO Sets Bold Sales Growth Outlook And Signals Q4 Profit — Retail Sees An Expectations Trap Forming

- Nio reaffirmed a targeted annual sales growth rate of 40%–50%.

- CEO William Li said costs are well-controlled and expressed confidence in achieving profitability in Q4.

- The company outlined plans for new model launches and platform upgrades.

U.S.-listed shares of Nio Inc. rose nearly 2% in premarket trading on Tuesday after CEO William Li laid out an aggressive outlook for the company’s next phase of growth, including a targeted annual sales increase of 40%–50% and confidence around achieving profitability in the fourth quarter (Q4).

Bold Growth Targets Take Center Stage

Li said Nio is entering its “third phase of development,” targeting annual sales growth of 40%–50% across its three brands, including Nio, Ledao and Firefly. The company delivered 326,028 vehicles in 2025, up 47% year-on-year, according to a report by ChinaEVHome.

Addressing profitability, Li said he is confident Nio will achieve positive results in Q4, citing deliveries of more than 40,000 units of the all-new ES8, which he said carries higher gross margins and contributed several billion yuan in additional gross profit. He added that cost control has improved.

Nio Lines Up 2026 Growth Plans

Nio said 2026 model-year vehicles will fully transition to its third-generation platform. The company plans new launches in the high-end mid-to-large segment, including the larger ES9 SUV in the second and third quarters.

Li also said Nio plans to push into lower-tier markets through integrated “Sky Stores” housing all three brands and aims to expand into up to 40 international markets by 2026 using a distributor-led model.

Technology And Infrastructure Push

Nio will focus on its “12 Full-Stack Technologies,” with cumulative R&D spending exceeding 65 billion yuan, including more than 18 billion yuan invested in battery swap and charging infrastructure. The company targets more than 10,000 charging stations and 10,000 battery swap stations by 2030, with fifth-generation swap stations set for large-scale rollout starting in April.

How Did Stocktwits Users React?

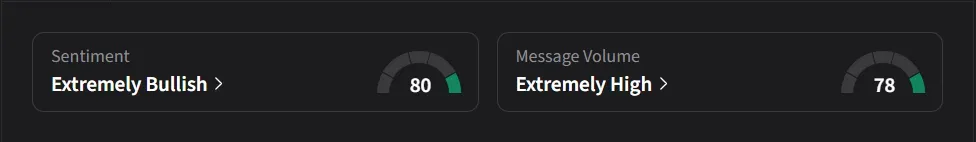

On Stocktwits, retail sentiment for Nio was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, citing “up to” 50% sales growth may have set expectations too high, warning that anything below that level could now be seen as a miss.

Another user highlighted William Li’s comments on profitability and costs, calling it a risk for bearish positions.

Nio’s U.S.-listed stock has risen 5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)