Advertisement|Remove ads.

Nikola Stock Thunders Ahead After Impressive Q3 Electric Truck Deliveries, Attracts Retail Spotlight

Shares of Nikola Inc. (NKLA) surged 20% on Wednesday after the company provided an optimistic third-quarter update, drawing a surge of attention from retail investors.

Nikola reported selling 88 Class 8 hydrogen fuel cell electric trucks in Q3, a 22% increase from the previous quarter, meeting its guidance of 80 to 100 units.

With 200 hydrogen trucks sold so far in 2024, Nikola is shifting momentum despite a tough year.

"This is a record sales quarter for Nikola, with 88 hydrogen fuel cell electric trucks wholesaled to our dealers for end customers, as well as the addition of a first-ever U.S. dealer-based HYLA modular refueling station," said Nikola CEO Steve Girsky.

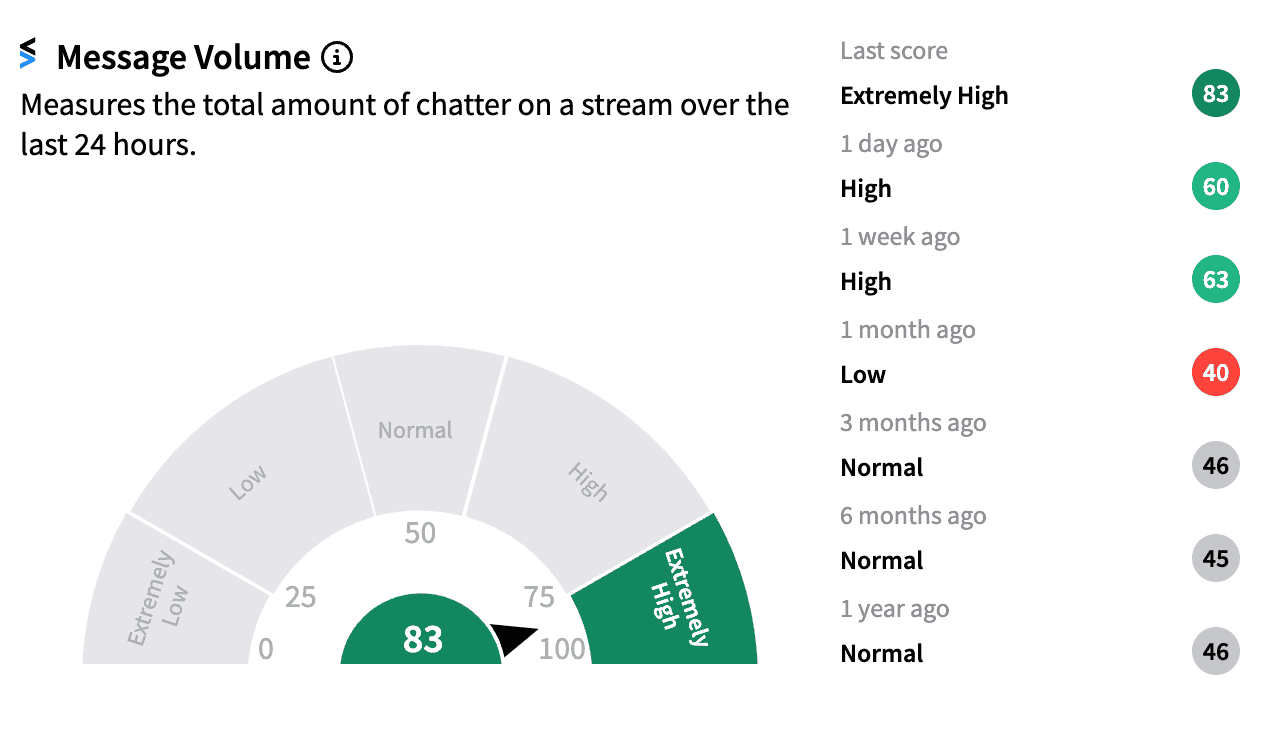

Retail interest spiked on Stocktwits, where message volume for Nikola jumped to ‘extremely high’ levels (83/100), marking the second-highest volume of the year.

Some watchers were also bullish on potential gains from the U.S. Department of Energy’s recent $1.2 billion investment in hydrogen technologies, which could further support Nikola’s expansion.

Despite the recent rally, Nikola’s stock remains down nearly 80% year-to-date, impacted by broader EV market struggles and a major recall of its battery-electric trucks due to fire risks.

However, the company’s pivot to hydrogen-powered vehicles and steady orders are offering signs of recovery.

This positive Q3 update follows strong second-quarter results in August, when Nikola topped Wall Street’s revenue expectations with $31.32 million and posted a smaller-than-expected loss of $2.67 per share.

Analysts now anticipate a reduced loss of $2.30 per share and revenue rising to $37 million for the current quarter, adding to the stock’s bullish outlook.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rigetti_computing_quantum_computer_representative_resized_bafe11454b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_red_cat_holdings_representative_resized_071bc0311e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trip_Advisor_jpg_c5134f02d2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239438284_jpg_9bc3b92eab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)