Advertisement|Remove ads.

NLC India Stock: SEBI RA Vijay Gupta Eyes ₹260 Target On Green Energy Bets

NLC India shares have gained 7% in the last one month, driven by anticipation surrounding Prime Minister Narendra Modi’s potential meeting on rare earth magnets.

SEBI-registered analyst Vijay Kumar Gupta noted that, following a period of sideways consolidation, NLC India is showing renewed strength, driven by green energy expansion and institutional confidence. Its technical breakout has aligned with fundamental triggers, he added.

In recent news developments, the cabinet allowed NLC India to invest ₹7,000 crore in its renewable energy subsidiary, NLC India Renewables (NIRL). The green energy arm is looking to launch its ₹4,000 crore initial public offering (IPO) in the next financial year to fund expansion. Gupta highlighted that this move will unlock value and strengthen balance sheet.

Additionally, Rajesh Pratap Singh Sisodia is set to be the next Director (Planning & Projects) of NLC India, indicating focus on project execution. He is currently serving as Executive Director (New and Renewable Business Group) of Bharat Heavy Electricals Limited (BHEL).

NLC posted a ₹656.2 crore net profit in its March quarter. Gupta noted that while thermal and lignite power generation remains its mainstay, the company’s shift towards renewable energy and upcoming IPO plans signal structural evolution.

Technical Trends

On its daily chart, NLC stock has rebounded sharply after two red sessions. Gupta observed that a breakout was seen above Ichimoku cloud, with its recent close above all major moving averages. Additionally, the spike in volumes, with follow-through, indicates that it has broken out of its accumulation zone.

Other technical indicators, such as the Commodity Channel Index (CCI), which is currently around 210, indicate that the stock is highly overbought. Gupta advises traders to watch for cooling. A barely positive Chaikin Money Flow (CMF) suggests renewed but still early-stage buying interest among investors.

Gupta identified resistance at ₹248.60 and ₹258, with support at ₹235.70 (cloud base) and ₹228 (gap-fill area). He set a medium-term target at ₹260+ if volume sustains.

He said that tactical entry near ₹236–₹239 (on dips) could offer favourable risk-reward. Adding that long-term investors can track IPO timelines for re-rating opportunities.

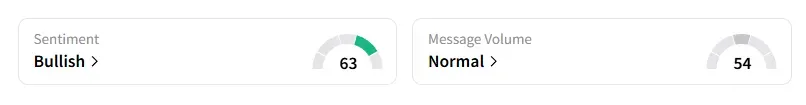

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago.

NLC India shares have risen 1% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_jpg_6a66f2327c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_original_jpg_b7bd478a67.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/zenatech_png_21d6cbd6b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitccoin_39176cc376.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)