Advertisement|Remove ads.

No Federal Bailout for AI, Says David Sacks — ‘If One Fails, Others Will Take Its Place’

- David Sacks’ comments follow OpenAI CFO Sarah Friar’s remarks about potential loan guarantees, which the company later clarified.

- Sacks reiterated that competition, not federal intervention, should guide AI industry outcomes.

- He also addressed what he called the “two biggest narratives” surrounding artificial intelligence.

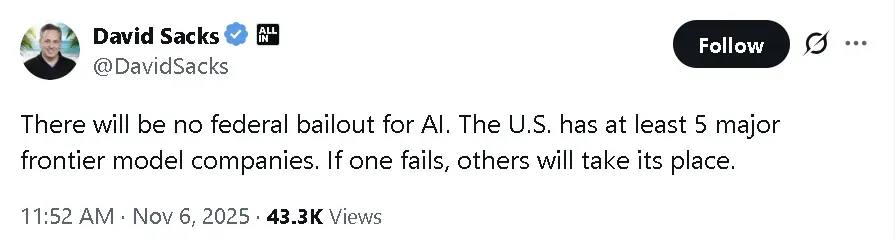

White House adviser David Sacks stated on Thursday that there will be no federal bailout for artificial intelligence companies.

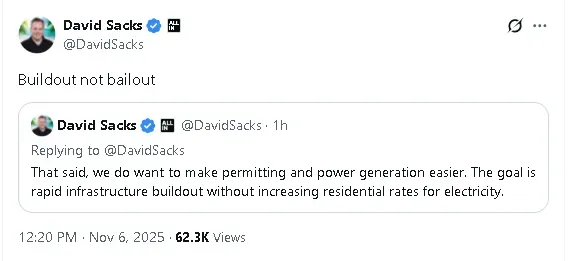

“The U.S. has at least five major frontier-model companies. If one fails, others will take its place,” he wrote in a post on X. Rather than offering blanket support, Sacks emphasized that the government’s role will shift toward making infrastructure and regulation more efficient, especially in areas like permitting and energy generation.

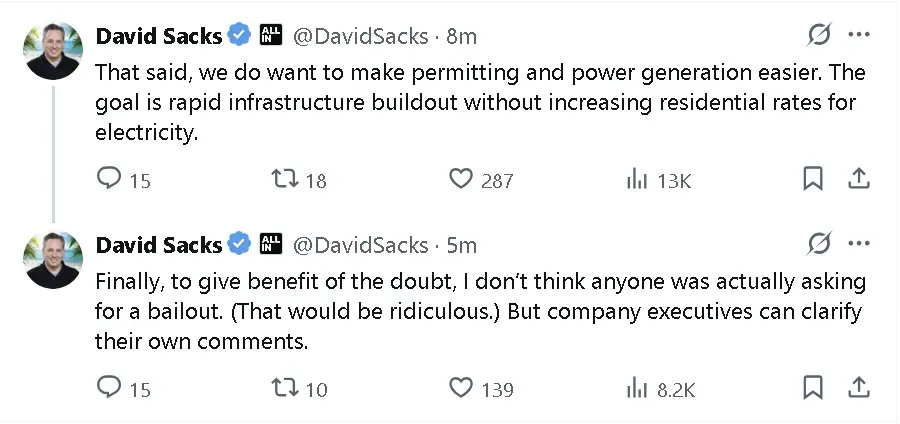

The goal, he noted, is a rapid build-out of AI infrastructure “without increasing residential rates for electricity.” This reflects a policy focus on unblocking constraints in power and permitting rather than direct subsidies.

OpenAI’s Comments Sparked The ‘Bailout’ Debate

Sacks’ remarks came days after OpenAI CFO Sarah Friar discussed the potential role of federal loan guarantees during The Wall Street Journal’s Tech Live conference. Friar said such guarantees could “really drop the cost of the financing” needed for the company’s infrastructure expansion.

OpenAI later clarified that it was not seeking any U.S. government loan guarantees. The company said the term “backstop” had caused confusion, and Friar subsequently emphasized that OpenAI’s funding plans rely on a mix of banks, private equity, and possibly some governmental support, rather than direct federal assistance.

"Everyone in Silicon Valley understands that the way to win a technology race is to get the most users and developers on your platform," Sacks said In a video Sacks uploaded alongside his comments. "Yet the anti-export lobby in Washington keeps inventing reasons why America’s friends and allies shouldn’t be allowed to build on the American."

Industry Bubble Or Superintelligence?

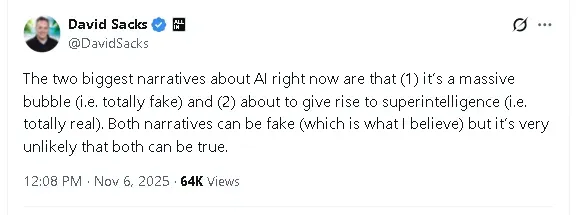

Sacks also addressed what he called the “two biggest narratives” surrounding artificial intelligence. “One is that it’s a massive bubble—totally fake—and the other is that it’s about to give rise to superintelligence—totally real,” he wrote. “Both narratives can be fake (which is what I believe), but it’s very unlikely that both can be true.”

His comments hint at the broader debate about the sustainability of AI valuations and the limits of current technology.

U.S. equities fell in midday trade on Thursday. The SPDR S&P 500 ETF (SPY) dipped 0.94%, the SPDR Dow Jones Industrial Average ETF (DIA) slipped 0.82%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) dropped 1.65%. Meanwhile, retail sentiment around QQQ on Stocktwits improved to ‘bearish’ from ‘extremely bearish’ territory over the past day.

AI stocks, which have moved unevenly since the start of November, continued their volatility during Thursday’s session. Palantir Technologies (PLTR) was down 5.5% in afternoon trade and among the top trending tickers on Stocktwits. AI bellwether Nvidia (NVDA) was also among the top trending tickers as its stock dipped 3.4%.

Read also: Ripple’s XRP Leads Crypto Rebound, While Bitcoin ETFs Log Second-Worst Outflow Streak This Year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)