Advertisement|Remove ads.

Novo Nordisk Stock Slumps After Slashing Full-Year Guidance, But Retail Has Its Eyes On An Oral Weight Loss Drug

Danish drugmaker Novo Nordisk (NVO) shares tumbled 20% on Tuesday after the company lowered its full-year 2025 outlook, citing lower growth expectations for its blockbuster weight loss drug Wegovy and diabetes drug Ozempic for the second half of the year.

The company now expects sales growth of 8% to 14% during the year at a constant exchange rate, down from its previous estimate of 13% to 21%.

Operating profit growth is now expected to be 10% to 16%, down from its previous outlook of 16% to 24%.

The company now sees lower growth for Wegovy in the U.S. obesity market and for Ozempic in the U.S. diabetes market, as well as lower-than-expected penetration for Wegovy in select international operations markets.

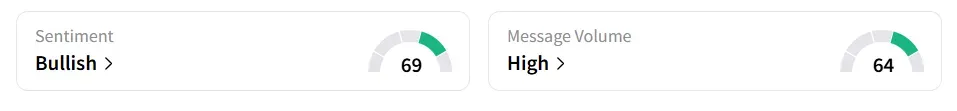

On Stocktwits, retail sentiment around Novo jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user opined that the stock will bounce on the company launching an oral weight loss drug in the future.

Novo Nordisk said in May that the FDA has accepted its new drug application for a once-daily oral formulation of Wegovy, and it expects a response from the agency in the fourth quarter (Q4) later this year.

Another Stocktwits user recommended a buyback of shares.

The new outlook for Wegovy in the U.S. reflects the persistent use of compounded versions of the drug, coupled with slower-than-expected market expansion and competition, the company said.

While the U.S. Food and Drug Administration has prohibited mass compounding for the active component in Wegovy called Semaglutide, unsafe and unlawful mass compounding has continued, the company said, citing its market research.

Ozempic outlook, likewise, is negatively impacted by competition in the U.S., the company added

In the first six months of 2025, Novo Nordisk’s sales increased by 18% and operating profit increased by 29%, both at constant exchange rate, as per the firm.

Separately, Novo Nordisk also said that Maziar Mike Doustdar has been appointed President and CEO, effective Aug. 7, and he will succeed Lars Fruergaard Jørgensen, who will step down on the same day.

Novo Nordisk will publish its full financial results for the first six months of 2025 on August 6.

NVO stock is down by 36% this year and by 57% over the past 12 months.

Read also: Merck’s Full Year Guidance Disappoints Investors But Retail Pins Hopes On $3B Cost-Cutting Plan

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)