Advertisement|Remove ads.

NTPC Green Gains After Gujarat Solar Deal, SEBI Advisor Sees Over 40% Upside Potential

NTPC Green Energy shares gained over 1% on Friday after the renewable arm of NTPC signed a memorandum of understanding (MoU) with the Gujarat government to develop solar parks. In one of the largest renewable deals in India, NTPC Green would develop solar parks and projects with a cumulative capacity of 10 GW and wind projects of 5 GW in the state.

Last month, the company had inked an MoU with Tamil Nadu government to boost green energy technologies. It is also developing the green hydrogen hub in Vishakhapatnam, Andhra Pradesh.

Bullish Bet On NTPC Green

SEBI-registered investment advisor Nidhi Saxena of The Trade Bond believes this move is bullish for NTPC Green as the renewable arm has emerged as the core growth driver for NTPC’s transition toward a cleaner energy future. It enjoys long-term revenue visibility driven by its robust order pipeline. And is positioned for a future IPO or separate listing, which could lead the market to re-rate NTPC Green as a pure renewable energy play.

However, Saxena also cautioned that the company faces challenges such as large capital expenditure requirements, potential delays in land acquisition and transmission infrastructure, and competitive tariff pressures. And there is the overhang of uncertainty in power purchase agreements (PPAs).

Technical Outlook

On the technical side, NTPC Green stock has been showing signs of accumulation and has formed higher lows, suggesting a bullish market structure.

Saxena pegged immediate support at ₹96 and major support at ₹92, while resistance is seen at ₹102, with a significant breakout likely above ₹108. A sustained move above ₹108 could open the doors to targets of ₹120 and ₹135. She added that if the stock holds above ₹96, it would keep the bullish momentum intact. But a break below ₹92 could weaken the trend.

Trading Call

For swing or positional traders, Saxena suggested buying NTPC Green between ₹96 and ₹100 with a stop loss at ₹92 on a closing basis. The upside targets remain ₹108, ₹120, and potentially ₹135 or higher.

In the short term, she expects the stock may test ₹102–108. And in the medium-term, a breakout above ₹108 can start a fresh rally. Over the long term, NGEL holds multi-bagger potential, particularly if it is listed independently or valued purely as a green energy entity. As long as it holds above ₹96, Saxena remains bullish on NTPC Green, with ₹108 marked as the critical breakout level to watch.

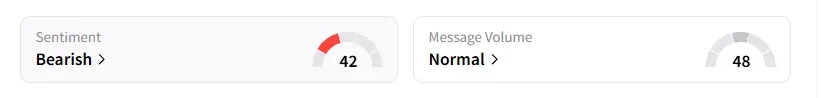

What Is The Retail Mood?

Data on Stocktwits showed that retail sentiment recently turned ‘bearish’. It was ‘neutral’ last week.

NTPC Green shares have declined 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)