Advertisement|Remove ads.

Nu Holding Stock Slips After Mixed Q1 Results, Retail’s Banking On Customer Growth

Nu Holdings (NU) stock slipped 2.8% in extended trading on Tuesday after the company’s first-quarter earnings fell short of expectations.

The Brazilian fintech firm reported adjusted earnings of $606.5 million, while analysts expected it to post a profit of $630.5 million, according to a Reuters report citing LSEG data.

Its first-quarter revenue of $3.25 billion topped estimates of $3.23 billion, according to FinChat data.

Nu, which operates in Brazil, Mexico, and Colombia, added 4.3 million new customers during the quarter, bringing its total customer count to 118.6 million.

The company’s risk-adjusted net interest margin declined to 8.2%, driven by the increase in the credit loss allowance.

Nu said it saw a rise in the loan-to-deposit ratio in Brazil, which helped it combat weakness in Colombia.

“We had a strong start to the year with continued customer growth. We now serve approximately 59% of Brazil's adult population, 12% in Mexico, and 8% in Colombia,” Chief Financial Officer Guilherme Lago said.

The company’s interest-earning portfolio rose 62% to $13.8 billion during the first quarter, on a foreign currency-neutral basis.

“While we've already reached a significant number of customers across Latin America, our market penetration remains relatively low, including in Brazil, and the opportunity to further grow revenue is enormous,” CEO David Velez said.

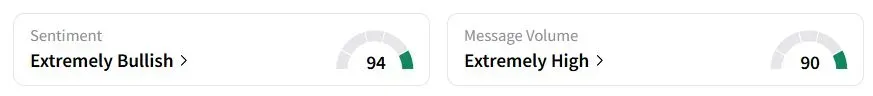

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (94/100) territory, while retail chatter was ‘extremely high.’

One bullish investor cited the new customer acquisition for taking up a long-term position.

Another user noted that the stock tends to underperform following its earnings reports.

Nu Holdings stock has risen 26.7% year to date (YTD).

Also See: Woodside Energy Draws Early Bullish Chatter On Probable Louisiana LNG Stake Sale To Saudi Aramco

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)