Advertisement|Remove ads.

Woodside Energy Draws Early Bullish Chatter On Probable Louisiana LNG Stake Sale To Saudi Aramco

Woodside Energy’s (WDS) U.S. shares garnered retail attention on Tuesday after the Australian firm signed a non-binding collaboration agreement with Saudi Aramco to explore a stake sale at its Louisiana LNG project.

Aramco could also look to buy liquefied natural gas from the $17.5 billion project, Woodside said.

The agreement was signed in Riyadh at the Saudi-US Investment Forum, which President Donald Trump attended. At the forum, the kingdom pledged to invest $600 billion in the U.S.

Woodside had agreed to sell a 40% stake in the LNG export plant to U.S.-based Stonepeak for $5.7 billion in April. The company said that on April 29, it was discussing a potential stake sale with other parties.

Woodside had bought Louisiana LNG through its $900 million acquisition of U.S.-listed Tellurian last year.

The company expects to build the project in stages, with the first three trains expected to produce 16.5 million tonnes of LNG per annum (Mtpa). The project has a total approved capacity of 27.6 Mtpa. The first LNG is expected in 2029.

The U.S. is already the world’s top LNG exporter. Demand for the commodity would likely surge even further as countries seek to reduce their trade deficit with the U.S. by purchasing more energy amid tariff concerns.

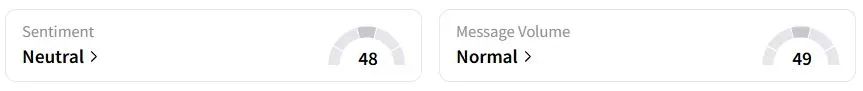

Retail sentiment on Stocktwits was in the ‘neutral’ (48/100) territory, while retail chatter was ‘normal.’

Woodside stock has fallen 9.7% year to date (YTD).

Also See: 'Not Fair To America,' Says Trump As He Urges 'Too Late' Powell To Cut Rates After April CPI Data

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)