Advertisement|Remove ads.

Nu Holdings Q1 Earnings Preview: Analysts Bet On Brazil, Retail’s Divided

Nu Holdings (NU) stock has risen 2.8% over the past week ahead of its quarterly earnings report on Tuesday.

According to FinChat data, Wall Street expects the Brazilian fintech firm to report earnings per share of $0.12 on revenue of $3.23 billion. The company has narrowly topped estimates in three of the previous four quarters.

In April, JP Morgan analysts noted that the firm has the potential to grow its earnings by over 30% in the next three years, which is "something hard to find," according to TheFly.

The brokerage also said that, assuming Brazil is a relative winner in the global trade war, Nubank should also be a relative winner for global and growth investors.

In the fourth quarter, the company added 4.5 million customers, reaching a

total 114.2 million customers globally by Dec. 31, reflecting a 22% year-over-year (YoY) increase.

Nu Mexico, the Mexican arm of the company, secured a banking license from the National Banking and Securities Commission (CNBV), enabling its transition from a Popular Financial Society (SOFIPO) to a full-service bank.

This milestone would allow Nu Mexico to expand its range of financial products, starting with the introduction of a payroll account.

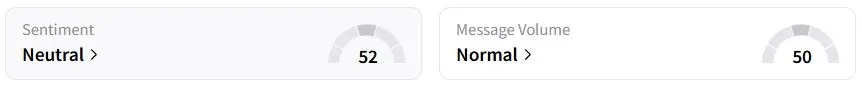

Retail sentiment on Stocktwits was in the ‘neutral’(52/100) territory, while retail chatter was ‘normal.’

One retail trader said the stock could jump to $14 after earnings.

Another user said the stock is not worth holding long-term if it dives again after earnings, despite its growth potential.

Nu Holdings stock has risen 23.7% year to date (YTD).

Also See: Lyft, Nuvve, Geo Group: Why These Industrial Stocks Saw The Biggest Rise In Retail Chatter Last Week

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_mcdonalds_store_jpg_130260f7da.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_RKLB_f09e0d1df7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Logo_Robinhood_png_254150c47e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)