Advertisement|Remove ads.

Why Did Insecticide Maker FMC Corp’s Stock Tumble Over 26% After-Hours?

- The insecticide and herbicide maker projected 2025 revenue between $3.92 billion and $4.02 billion, compared with its previous forecast of $4.08 billion and $4.28 billion.

- FMC said pricing is expected to have a mid-to-high single-digit percentage-point impact on its full-year earnings, as it continues to grapple with a high influx of generic products.

- The company also recorded approximately $510 million in charges and write-downs in the third quarter as part of its plans to divest its commercial operations in India.

FMC Corp (FMC) stock fell 26.3% in extended trading on Wednesday after the company lowered its full-year forecasts and slashed its dividend to rein in costs.

The insecticide and herbicide maker projected 2025 revenue of $3.92 billion to $4.02 billion, down from its previous forecast of $4.08 billion to $4.28 billion. FMC also cut its earnings per share forecast to $2.92 to $3.14, down from $3.26 to $3.70 earlier.

Its third-quarter adjusted earnings of $0.89 per share topped estimates of $0.85 per share, according to Fiscal.ai data. However, adjusted quarterly revenue of $961 million fell short of estimates of $1.06 billion.

Why Did FMC Trim Its 2025 Outlook?

FMC said that pricing is expected to be a mid-to-high single-digit percentage point impact on its full-year earnings, as it continues to grapple with a high influx of generic products, which is hampering the sales of the company’s proprietary products. Its Latin America sales fell 8% compared to a year earlier in the third quarter.

"Our results reflect the challenges we're facing, most prominently in Latin America. Despite this, our new active ingredients nearly doubled in the quarter and remain central to our strategy," said FMC CEO Pierre Brondeau in a statement.

The company added that low customer liquidity caused credit constraints in Brazil and Argentina, further inhibiting growth. Prices of key crops such as soybeans and corn have remained under pressure for much of the year, prompting farmers to cut spending on insecticides and fungicides.

The company also recorded approximately $510 million in charges and write-downs in the third quarter as part of its plans to divest its commercial operations in India due to challenges in the country. It also slashed its quarterly dividend by 86% to $0.08 to focus on debt reduction.

What Is Retail Thinking?

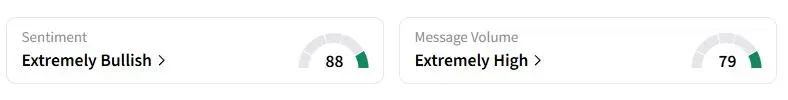

Retail sentiment on Stocktwits about FMC stock was still in the ‘extremely bullish’ territory at the time of writing, compared with ‘bearish’ a day ago.

“This is pretty shocking after-hours action. Looking forward to a recovery, but [it] may take a while,” one user wrote.

Some traders were also fine with the dividend cut and saw it as a buying opportunity, hoping sales would improve after the current three-month cycle.

FMC stock has fallen 40% this year, compared with 11.1% gains in rival Corteva’s shares. The latter firm is separating its seed and pesticide businesses as part of a strategic realignment in response to current market conditions.

Also See: OpenAI IPO Could Be The Biggest Ever, Aiming For A Whopping $1 Trillion Valuation: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)