Advertisement|Remove ads.

Nvidia Stock Heads For Strong Weekly Finish After CEO Jensen Huang Talks Soaring Demand For AI Chips: Retail Retains Cheer

Shares of Nvidia Corp. (NVDA) edged up pre-market trading Friday, building on Thursday’s nearly 2% gain. If the momentum holds, the stock is poised for its fifth consecutive day in the green, with a more than 15% rise this week alone.

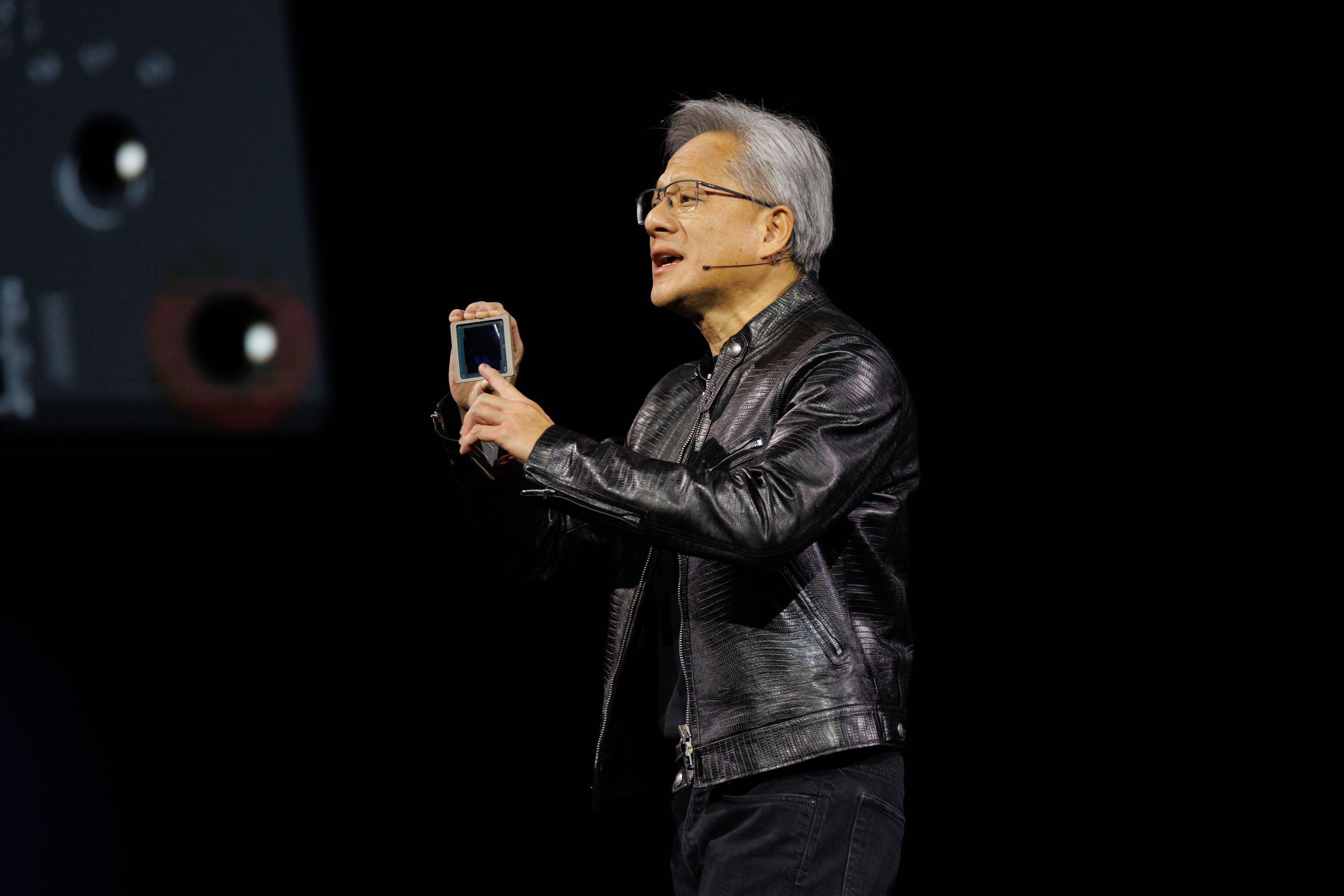

The surge follows bullish remarks from Nvidia CEO Jensen Huang at a Goldman Sachs technology conference, where he highlighted the overwhelming demand for the company’s AI chips.

“Everything is sold out,” Huang said, emphasizing the race among customers to secure Nvidia’s cutting-edge infrastructure for artificial intelligence. “We probably have more emotional customers today. Deservedly so. It’s tense. We’re trying to do the best we can.”

Nvidia’s chips power AI infrastructure for major cloud providers, including Microsoft (MSFT) and Amazon (AMZN), both of which have announced plans to increase spending on AI technology.

Additionally, reports that the U.S. government is considering allowing Nvidia to export advanced chips to Saudi Arabia further bolstered investor sentiment, potentially expanding the market for the chipmaker’s technology.

This week, Huang also met with OpenAI CEO Sam Altman and senior Biden administration officials at the White House to discuss the growing infrastructure needs for AI projects, underscoring Nvidia’s central role in the AI boom.

Analysts have largely shrugged off earlier concerns about delays in Nvidia’s upcoming Blackwell chips.

Bernstein analyst Stacy Rasgon noted that fears around potential delays were “mostly a nothing-burger” and that Nvidia could still achieve “substantial” revenue from the new chip lineup in the fiscal fourth quarter, with a “likely massive ramp next year.”

Rasgon added that margin worries appear overblown, with expectations of 73% to 74% margins in Q4, likely improving as Blackwell costs are optimized and pricing firms up.

Nvidia’s recently announced $50 billion stock repurchase plan, unveiled alongside its latest quarterly earnings, is also drawing interest from retail investors, with sentiment on Stocktwits remaining bullish (61/100) among its 536,000 followers.

The company’s stock has risen an impressive 147% this year, reflecting continued optimism around its dominant position in the AI chip market and the strong demand driving its growth.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)