Advertisement|Remove ads.

Nvidia Goes Parabolic With $4 Trillion Club Entry, But Most Retail Traders Are Loading Up Or Holding: Analysts Brace For FOMO Buying

Nvidia stock has rebounded after losing momentum in the first quarter. As the stock closed at a fresh record on Wednesday, the Jensen Huang-led company surpassed the $4 trillion mark, thus becoming the first company to achieve this milestone.

The rally may not be done yet, with Wall Street modeling further gains for Nvidia stock. The Koyfin-compiled consensus price target for the stock is $174.18, implying incremental upside of nearly 8%.

Chart courtesy of Koyfin

Chart courtesy of Koyfin

About a month ago, Nvidia's trading chart revealed the formation of a "golden cross" (50-day moving average crossing above the 200 DMA) — a bullish technical signal that indicates a potential long-term uptrend.

Retail investors on the Stocktwits platform suggested that they would double down on the stock despite the 21.31% year-to-date gain. The recent gains have pushed the stock into oversold territory, with the relative strength index (RSI) at 73.45.

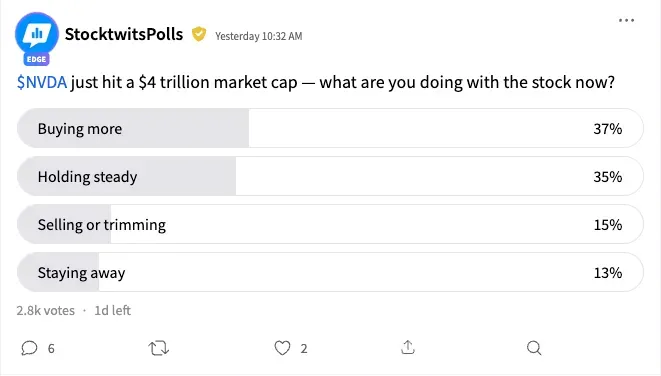

An ongoing Stocktwits poll, which asked users what they were doing with the stock, has received responses from 2,800 users so far.

A majority (37%) said they would buy more shares, and a slightly smaller 35% said they would hold onto their positions. Those looking to sell or trim accounted for 15% of the respondents, and 13% said they would stay away from the stock.

Explaining his stance, a bullish user said, “Bears are still making the mistake of thinking of this as a ‘chip stock’ or an ‘AI stock’. It isn't. It's an infrastructure stock.”

“The plain and simple truth is that the world is going to need exponentially more computing power, year over year, for the foreseeable future. And NVDA is the king.”

However, another user said they would accumulate AMD stock.

At Wednesday’s close, Nvidia’s valuation was just shy of the $4 trillion level.

When the company hit the milestone on Wednesday, Wedbush analyst Daniel Ives, a tech bull, said, “This is a historical moment for Nvidia, the tech space flexing its muscles, and speaks to the AI Revolution hitting its next stage of growth led by the one chip fueling AI.”

He expects the company to reach the next milestone of $5 trillion within the next 18 months, based on his view that the current tech bull market is still in its early stages, driven by the AI Revolution.

While appearing on an interview with Yahoo Finance on Wednesday, RBC Head of Derivative Strategy Amy Wu Silverman said the biggest fear of institutional investors is not about potential downside but about missing out.

“I wouldn't be surprised if it keeps going from here, too,” she said.

In Thursday's early premarket session, Nvidia stock rose 0.61% to $163.87.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Indian Delegation Plans US Visit To Seal Trade Deal As Trump Ramps Up Tariff Threats: Report

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lightwave_logic_jpg_403d7ad9c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Oracle_logo_1200pi_gettyimages_resized_jpg_28799a64ef.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)