Advertisement|Remove ads.

Nvidia’s AI Roadmap Draws Analyst Confidence, Prompting Multiple Target Price Hikes

- Morgan Stanley raised Nvidia’s price target to $220 from $210.

- Analyst Joseph Moore said he expects ‘strongest result we have seen in the last few quarters’ as Blackwell enters full ramp-up.

- Wells Fargo has also increased its price target to $265, up from $220.

NVIDIA Corp’s (NVDA) AI dominance continues to draw increasingly bullish views from Wall Street analysts, with both Morgan Stanley and Wells Fargo lifting their price targets on the back of demand for its Blackwell architecture.

Morgan Stanley analyst, Joseph Moor raised the 12-month price target for the AI bellwether to $220 from $210 and retained an ‘Overweight’ rating.Wells Fargo has also increased its price target to $265, up from $220.

The move reflects growing optimism around AI-related semiconductor demand and supply-chain momentum.

What’s Driving the Price Target Raise?

Moore stated that his firm’s checks show material acceleration in the AI chip business and expects what he described as the ‘strongest result we have seen in the last few quarters’ as Blackwell enters full ramp-up, according to TheFly.

He also highlighted what he called ‘very strong’ demand signals for the forthcoming Rubin platform, and emphasized that Nvidia’s Blackwell architecture remains the chip of choice across enterprise AI customers.

He noted that while the stock has lagged some peers in the AI theme, he believes that underperformance should reverse, given the fundamentals in motion.

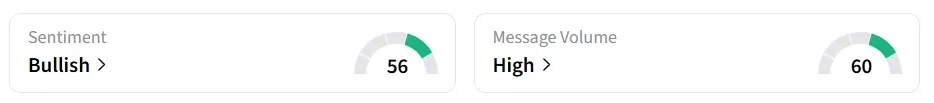

Nvidia’s stock traded over 2% lower in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Wells Fargo Echoes Optimism

Wells Fargo has also increased its price target to $265, up from $220, while maintaining an ‘Overweight’ rating. The firm expects strong upside for the company’s upcoming third-quarter (Q3) 2026 and fourth-quarter (Q4) 2026 guidance, projecting revenue in the range of $50 billion to $52 billion and $58 billion to $60 billion, respectively.

The firm cites Nvidia’s consistent growth, robust AI pipeline, and dominant datacenter presence as key drivers.

All Eyes On Earnings Next

Nvidia will report Q3 earnings on November 19. According to Fiscal AI data, analysts expect Nvidia to post a Q3 revenue of $54.8 billion and earnings per share (EPS) of $1.25.

NVDA stock has gained over 39% in 2025 and over 27% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228840051_jpg_b05caad6aa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)