Advertisement|Remove ads.

Nvidia Stock Slips Ahead Of Q4 Earnings As Trump Reportedly Mulls Tighter China AI Chip Curbs – Retail Investors Hesitant

Nvidia (NVDA) shares edged lower by 0.5% in afternoon trade on Tuesday amid the broader market slump following a report about harsher curbs on semiconductor sales to China ahead of its fourth-quarter earnings results.

The stock fell by as much as 2.7% before paring its losses through the day.

The Trump administration has begun discussions on tightening restrictions on chip sales to China, Bloomberg reported, citing sources familiar with the matter.

Stricter regulations could limit Nvidia’s ability to sell its chips to major Chinese technology firms such as Alibaba Group, Tencent, and TikTok owner ByteDance, potentially impacting its revenue.

According to a separate Reuters report, all three companies have been buying up more of Nvidia’s China-compliant H20 chips since DeepSeek’s artificial intelligence model surged in popularity last month.

The semiconductor bellwether is expected to report fourth-quarter (Q4) earnings after the closing bell on Feb. 26.

Analysts expect the company to post earnings of $0.85 per share on revenue of $38.16 billion.

For the full year, Wall Street is forecasting earnings of $2.95 per share on revenue of $129.3 billion.

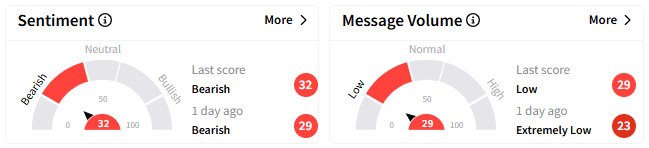

Retail sentiment on Stocktwits remains in ‘bearish’ territory, with retail chatter at ‘low’ levels.

However, some investors believe Nvidia’s earnings report could catalyze a rebound.

Despite recent weakness, Nvidia retains strong backing from analysts.

Of the 61 analysts covering the stock, 57 maintain a ‘Buy'-equivalent rating, with an average price target of $171.64—implying a 33% upside from current levels.

Nvidia’s stock has fallen 5.5% year to date but remains up more than 61% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)