Advertisement|Remove ads.

Nvidia Stock Surges As BofA Calls It ‘Very Compelling’ Ahead of GTC – Retail’s Divided Amid Broader Market Volatility

Nvidia (NVDA) shares rose as much as 5.5% in midday trading Wednesday after Bank of America (BofA) reiterated a ‘Buy’ rating with a $200 price target, calling the stock “very compelling” ahead of the company’s annual GPU Technology Conference (GTC) next week.

BofA expects Nvidia to highlight its product pipeline at the event, offering updates on Blackwell Ultra, Rubin, and next-generation networking aimed at scaling performance, according to TheFly.

The brokerage also anticipates that Nvidia will discuss its long-term ambitions in autonomous vehicles, physical AI, robotics, and quantum computing.

BofA Analyst Vivek Arya pointed out that Nvidia’s valuation is “very compelling," stating that the stock is trading at a lower price-to-earnings ratio than its expected earnings growth rate, suggesting it is undervalued relative to its future earnings potential.

Arya also noted Nvidia’s ability to maintain a strong competitive edge despite challenges from custom chip alternatives.

He stated that Nvidia’s market share remains robust, particularly in the GPU space, due to its extensive product offerings and platform-level innovations.

Other analysts are closely watching for conference updates as well.

Melius Research analyst Ben Reitzes is focused on CEO Jensen Huang’s keynote on March 18, looking for signals on how Nvidia plans to navigate AI-driven advancements amid regulatory uncertainty and potential tariffs.

“At this point, we believe Nvidia and several others in the AI semiconductor and hardware space are attractively priced,” Reitzes wrote. “That doesn’t mean stocks will perform well in the near term, given the lack of clarity on regulations, geopolitics, and tariffs.”

Melius maintains a ‘Buy’ rating on Nvidia with a $170 price target.

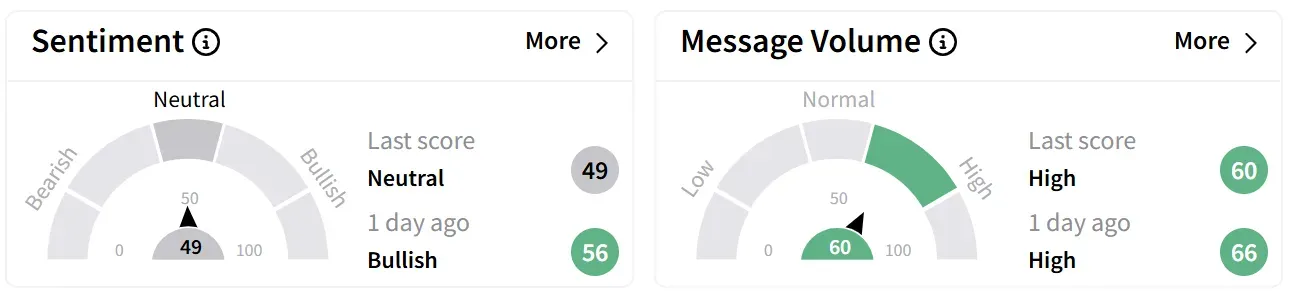

Meanwhile, retail sentiment on Stocktwits around Nvidia’s stock trended lower into the ‘neutral’ territory from ‘bullish’ a day ago, accompanied by ‘high’ levels of chatter.

One user noted they would prefer the stock to close strong rather than see long wicks on the chart, which signals indecision.

Another pointed to a spike in the CBOE VIX, which measures market volatility, suggesting Nvidia’s gains might not hold.

Nvidia shares have climbed 30% over the past year but remain down 15% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Teradyne Stock Continues Tumble As Wall Street Slashes Price Targets – Retail Sentiment Holds Firm

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)