Advertisement|Remove ads.

SPY Climbs As Weak Jobs Data Fuels Rate Cut Hopes, Amazon’s Earnings Lend Support: Retail Mood Lackluster

The SPDR S&P 500 ETF Trust ($SPY) rose in early trading on Friday following an unexpected October non-farm payrolls report, which boosted expectations for another interest rate cut from the Federal Reserve next week.

The exchange-traded fund that tracks the performance of the broader S&P 500 Index, also drew encouragement from Amazon, Inc. ($AMZN) stock’s earnings reaction.

Ahead of the market open, the Bureau of Labor Statistics released a report that showed that the U.S. economy added 12,000 jobs, sharply below the 113,000 number that was penciled in by economists.

The September job growth was upwardly revised from 159,000 to 223,000.

The unemployment rate based on the household survey was unchanged at 4.1%, in line with expectations,

The annual rate of the average hourly earnings, a key inflation measure, was also unchanged at 4%.

Following the jobs report, the 10-year Treasury note yield initially slipped but is up 4.3 points to 4.327%.

Commenting on the data LPL Chief Economist Jeffrey Roach said, “The storms across the southeast likely affected collection rates for the establishment survey; however, response rates for the household survey were within normal ranges.”

The economist recommended focusing on the household survey. Among the key data he flagged from the survey are the percentage of long-term unemployed, which was at 22% of the total unemployed persons compared to 19.5% before the pandemic shutdowns.

The employment-to-population ratio for prime age workers (25-54 years old) edged down to 80.6%, matching pre-COVID rates, he added.

“Given the storm-related distortion, the Fed is in a tight spot as they adhere to data-dependency,” Roach said, adding that further complicating things for policy makers are the recent data revisions to income, spending, and savings rates.

The economist, however, expects the Fed to cut rates in the remaining two meetings as economic conditions weakened.

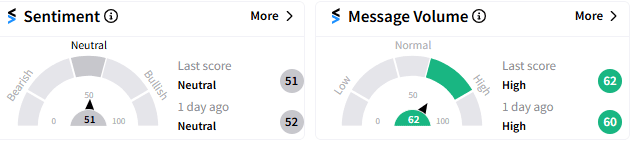

On Stocktwits, sentiment meter for SPY was stuck at "neutral," with message volume remaining “high.”

A user on Stocktwits platform said the data cements hopes for rate cuts by the Fed.

Another pointed to the oversold zone the SPY is in as an argument to buy.

A third user saw SPY's climb as "pump-and-dump" ahead of election.

As of 11:30 am ET, SPY rallied 1.15% to $575.18.

Read Next: Amazon Stock Poised To Reclaim $200 Following Q3 Beat, Retail Mood Upbeat

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)