Advertisement|Remove ads.

Ocular Therapeutix Stock Sees Worst Day In Nearly A Year On Q4 Miss, But Retail Sees A Comeback

Shares of Ocular Therapeutix (OCUL) plunged nearly 17% on Monday, marking their steepest single-day decline since April, as the biotech firm's fourth-quarter earnings missed expectations. The stock extended losses in after-hours trading.

The company posted Q4 revenue of $17.08 million, slightly below analysts' estimates of $17.16 million. While its quarterly loss narrowed to $0.29 per share from $0.35 a year earlier, it still came in wider than the Street's forecast of $0.27 per share.

Ocular also announced a delay in releasing late-stage trial data for axpaxli, its experimental treatment for wet age-related macular degeneration (wet AMD), shifting the timeline from Q4 2025 to Q1 2026. The adjustment follows FDA approval of study protocol changes under a Special Protocol Agreement (SPA).

Despite the earnings disappointment and trial delay, Ocular reaffirmed its financial stability, reporting a cash balance of $392.1 million as of Dec. 31, 2024, which it expects to fund operations into 2028 without the need for additional capital raises this year.

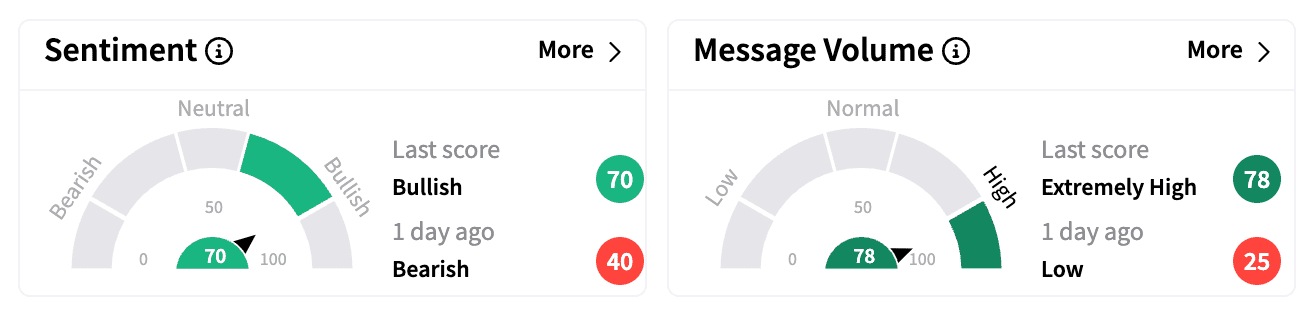

Retail sentiment on Stocktwits flipped to 'bullish' from 'bearish' amid the sell-off, with message volume surging 2,200% by the end of Monday's regular session.

One trader argued that selling the stock now could mean missing a long-term payoff, setting a personal price target of $25 — implying a potential 500% upside from the last close.

Another investor expressed optimism but questioned why the company didn't provide updated enrollment figures for its SOL-R (Phase 3, wet AMD) trial or 2025 revenue guidance for Dextenza, an FDA-approved corticosteroid for post-surgical inflammation and allergic conjunctivitis.

Ocular modified its SOL-R trial protocol, reducing the number of randomized subjects from 825 to 555, citing "strong" ongoing enrollment. As of Jan. 10, 2025, 311 subjects had been enrolled across various stages in the U.S. and South America.

OCUL stock has tumbled more than 31% year-to-date.

Wall Street analysts remain bullish — of the nine analysts covering the stock, five rate it a 'Buy,' while four call it a 'Strong Buy,' according to Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)