Advertisement|Remove ads.

Oil Stocks Feel The Heat As OPEC+ Proceeds With Production Raise, Retail’s Still Bullish

Oil companies' stocks tumbled on Monday after the OPEC+ producer group said it would move ahead with planned increase in output from April amid worries over Trump's tariffs.

The group, which consists of the Organization of the Petroleum Exporting Countries (OPEC) and other allies such as Russia, will gradually restore 2.2 million barrels per day (bpd) of production by 2026.

OPEC+ said the decision was based on ‘healthy market fundamentals and the positive market outlook.’

Since 2022, the producer group has been curtailing production to support oil prices. Currently, it has cut production by 5.85 million bpd.

The International Energy Agency had predicted an oil market oversupply in 2025 as demand remained tepid in China, the world's top consumer.

According to multiple media reports, the group would raise production by 138,000 bpd in April.

In January, U.S. President Donald Trump urged the oil supplier group to lower the prices of the commodity at the World Economic Forum in Davos.

On Monday, Trump said that 25% tariffs on Canadian and Mexican goods would come into effect on Tuesday. The administration has also imposed 10% tariffs on Canadian energy exports.

The U.S. would also double the tariffs on Chinese goods to 20% as the Trump administration believes the countries have not been able to stop fentanyl shipments into the U.S.

Wall Street’s major indexes declined following Trump’s announcement as fears grew that a trade war would stoke inflation.

The Energy Select Sector SPDR Fund (XLE) and Vanguard Energy ETF (VDE) fell 3.5% and 3.8%, respectively.

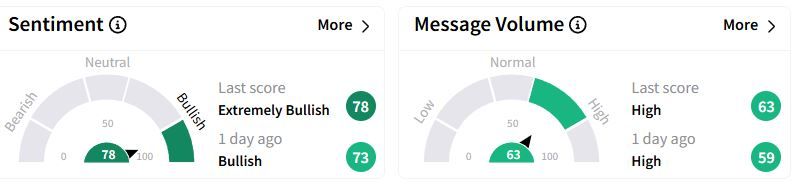

Retail sentiment about XLE on Stocktwits rose to ‘extremely bullish’ (78/100) territory from ‘bullish’(73/100) a day ago, while retail chatter was ‘high.'

One bullish user viewed the news positively and said that OPEC+ would not have made the decision if there had been a lack of demand.

Among individual company stocks, Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP) fell between 3.2% and 6.6%.

Also See: Kroger Stock Dips After CEO Rodney McMullen Resigns: Retail Mood Takes A Hit

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)