Advertisement|Remove ads.

LMT Stock Gets An Upgrade On Strong 2026 Growth Prospects – Analyst Believes Risks Tied To Costly, Delayed Weapons Systems Have Eased

- The new price target potentially implies a 17% upside to the stock’s price as of Thursday’s close.

- Truist pointed to improving execution, declining estimated acquisition costs (EACs), and attractive valuation metrics.

- Analyst Michael Ciarmoli cited Lockheed Martin’s experience in delivering complex defense programs as a key advantage against new industry competitors.

Truist has lifted its outlook for Lockheed Martin Corp. (LMT), upgrading the aerospace and defense giant to ‘Buy’ from ‘Hold’ while increasing its price target to $605 from $500.

The new price target potentially implies a 17% upside to the stock’s price as of Thursday’s close. The move comes as Truist points to improving execution, declining estimated acquisition costs (EACs), and attractive valuation metrics as catalysts for potential gains in 2026.

Analyst Rationale

Truist noted that the firm's expanding global orders and capacity growth are expected to accelerate key segments, particularly in missiles and fire control, which could generate double-digit growth over the coming year, according to TheFly.

According to a CNBC report, analyst Michael Ciarmoli emphasized that risks tied to costly, delayed weapons systems have eased following the dissolution of DOGE, a factor that had previously weighed on the stock.

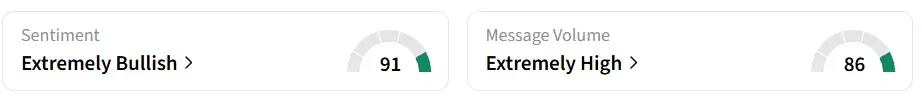

Lockheed stock traded over 4% higher by Friday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Valuation Attractiveness

Ciarmoli noted that Lockheed Martin has lagged the broader S&P 500, rising less than 11% over the past year compared to the S&P 500’s 17% gain. Trading at a forward price-to-earnings ratio of 17, the company remains below peers like Northrop Grumman (NOC) at 20 and Raytheon (RTX) at 27, highlighting a favorable entry point for investors seeking strong risk-adjusted potential.

The analyst cited Lockheed Martin’s experience in delivering complex defense programs as a key advantage against new industry competitors, according to the report.

“We also believe LMT’s expertise and track record of success in exquisite systems provides a level of durability and a sustainable competitive advantage over new entrants,” said Ciarmoli.

The upgrade coincides with President Donald Trump’s proposal for a $1.5 trillion military budget for 2027, potentially opening the door to additional Lockheed contracts. On Tuesday, the company signed a major long-term agreement with the U.S. Department of War to increase production of the PAC-3 Missile Segment Enhancement (MSE) interceptor.

LMT stock has gained over 15% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)