Advertisement|Remove ads.

ONEOK Q4 Earnings Preview: Analysts Say Execution To Be Driver Of Stock Performance, Retail Stays Bullish

ONEOK Inc (OKE) gained 1.6% over the past week ahead of its fourth-quarter earnings report, which is scheduled for Monday after the bell.

According to Koyfin data, Wall Street expects ONEOK to report fourth-quarter earnings per share of $1.54. The company has topped market expectations only once in the last four quarters.

The U.S. midstream companies ramped up their capacity last year due to anticipated demand growth from gas-powered plants, and electricity generators anticipate a rise in consumption from artificial intelligence data centers.

According to The Fly, Barclays analysts noted that the company's ability to execute following its recently acquired assets will be a key determinant of stock performance while the company builds its Permian NGL wellhead-to-water strategy.

Scotiabank analysts expected near-term share performance for the midstream group to be choppy overall but noted that the choppiness would eventually give way to ‘the constructive backdrop also at play,’ as per TheFly.

The company had agreed to buy the remaining units of EnLink Midstream for $4.3 billion.

ONEOK had raised its quarterly dividend by 4% to $1.03 per share in January.

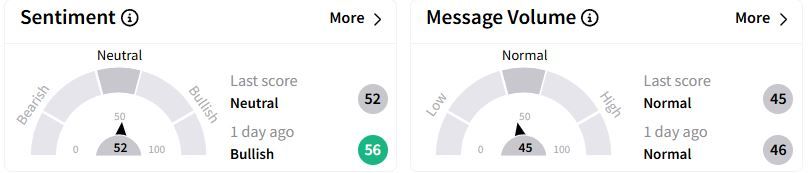

Retail sentiment on Stocktwits remained in the ‘bullish’ (61/100) territory, while retail chatter remained ‘low.'

Over the past year, ONEOK stock has gained 36.4%, but over the past month, it has fallen 9.8%.

Earlier in February, rival Energy Transfer had missed fourth-quarter revenue estimates due to lower transportation revenue.

Also See: Coterra Energy Q4 Earnings Preview: Weak Oil Prices To Dent Income, Retail’s Neutral

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)