Advertisement|Remove ads.

Opendoor Stock Surges Following Trump’s $200B Mortgage Bond Proposal: Retail Says ‘It’s All Coming Together Perfectly’

- The announcement comes a day after Trump revealed a proposal to prohibit large institutional investors from acquiring single-family rental properties, a step he said will curb corporate influence that has pushed up housing prices.

- Opendoor stock has seen a whopping 23% gain year-to-date.

- In November, Opendoor said its third-quarter revenue fell 34% year-on-year and that its net loss widened.

Opendoor Technologies, Inc. (OPEN) surged over 13% on Friday on investor optimism about President Donald Trump’s $200 billion mortgage bond proposal.

On Thursday, Trump announced plans to direct the federal government to purchase $200 billion in mortgage bonds, aiming to lower mortgage rates and make homeownership more attainable for Americans.

“I am instructing my representatives to buy $200 billion in mortgage bonds. This will drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable,” Trump said in a Truth Social post.

Trump's latest proposal has rekindled optimism among retail investors. The announcement comes a day after Trump revealed a proposal to prohibit large institutional investors from acquiring single-family rental properties, a step he said will curb corporate influence that has pushed up housing prices.

How Did Stocktwits Users React?

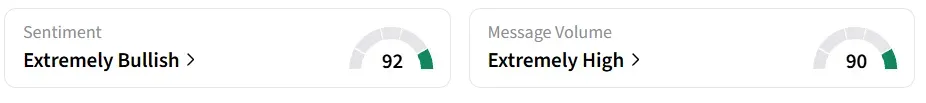

Opensoor stock was the top trending ticker on Stocktwits at the time of writing. Retail sentiment around the stock remained in ‘extremely bullish’ amid ‘extremely high’ message volume levels.

A bullish Stocktwits user said the stock will be ‘one of the biggest success stories of 2026’.

Another user lauded the company’s leadership team.

One user suggested holding the stocks for more gains.

A Good Start For 2026

In November, Opendoor said its third-quarter revenue fell 34% year-on-year, with a widening net loss, and projected a sales drop again in the fourth quarter. Consequently, the stock plunged by more than 24% in December. However, the stock has gained 23% year-to-date.

OPEN stock has gained over 392% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)