Advertisement|Remove ads.

Latham Group Stock Surges After-Hours On Robust 2025 Forecast, Q4 Sales Beat: Retail’s Extremely Bullish

Latham Group (SWIM) stock jumped 13.7% in extended trading on Tuesday after the company forecasted 2025 sales above Wall Street’s expectations.

The swimming pool designer projected 2025 net sales between $535 million and $565 million, while analysts, on average, expect the company to post $529.8 million in sales, according to FinChat data.

The company said its fourth-quarter net sales fell 4% to $87.3 million compared to the year-ago quarter due to challenging industry conditions. However, its revenue exceeded Wall Street’s expectations of $85.1 million.

Latham, which has operations in North America, Australia, and New Zealand, posted a net loss of $29.2 million, or $0.25 per share for the quarter, compared with a year-ago profit of $0.1 million.

The company attributed a large share of the loss to non-recurring non-cash income tax expenses and losses on foreign currency transactions.

Latham said its profit margins during the quarter benefited from increased efficiency and its acquisition of Coverstar Central, last year.

“Latham’s leadership position in fiberglass pools was a key driver of our pool market outperformance against the U.S. in-ground pool starts, which were down approximately 15% in 2024,” Scott Rajeski said.

The company forecasted flat new pool starts in 2025 compared with 2024.

“Industry conditions heading into this year are slightly more favorable than one year ago, but we believe trough market conditions are likely to continue through much of 2025,” Rajeski added.

It expects capital spending between $27 million and $33 million, an increase of $10 million over 2024 at midpoint, based on plans to drive fiberglass adoption in the Sand States.

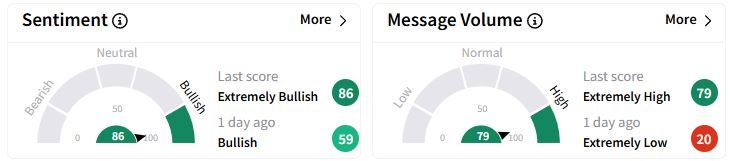

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (86/100) territory from ‘Bullish’(59/100) a day ago, while retail chatter rose to ‘extremely high.’

Over the past year, Latham stock has gained nearly 70%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)