Advertisement|Remove ads.

Oscar Health Now Expects Loss From Operations Of $200M To $300M In 2025: Here’s What Retail Thinks About The Stock Price

Oscar Health, Inc. (OSCR) on Tuesday cut its full-year financial guidance and provided second-quarter (Q2) earnings estimates below Wall Street expectations owing to higher-than-estimated medical costs.

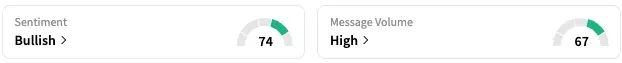

On Stocktwits, retail sentiment around Oscar is trending in the ‘bullish’ territory, accompanied by ‘high’ message volume.

According to Stocktwits data, the message count around Oscar has increased by over 303% in the past 24 hours and by 836% over the last 30 days.

The company stated that it now anticipates a loss from operations of approximately $230 million and a net loss of roughly $228 million for the second quarter of 2025. Wall Street expects the health insurance company to report a net income of $98 million, as per Koyfin data.

The company expects to release final second-quarter 2025 financial results before the opening bell on Wednesday.

The firm said that the estimate announcement is driven by a review of data from an independent actuarial firm, Wakely, which flagged high risks in Affordable Care Act markets and covers nearly 100% of Oscar’s geographic footprint.

The data, Oscar said, noted that the average morbidity of the market has increased by more than the company’s prior estimates. Based on the data, the company now expects a medical loss ratio of 86.0% to 87.0% for the full year 2025, higher than its previous guidance of 80.7% to 81.7%. The medical cost ratio refers to the percentage of premium income that the company pays out for medical costs.

Utilization by Oscar’s members remained elevated in the second quarter of 2025, the company stated, although cost trends moderated compared to the first quarter of 2025.

Oscar also revised its full-year earnings and revenue outlook. For 2025, the company now anticipates total revenue of $12.0 billion to $12.2 billion, up from its previous guidance of $11.2 to $11.3 billion.

The company now expects a loss from operations of $200 million to $300 million, down from its prior estimate of earnings from operations of $225 million to $275 million.

Oscar expects an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of approximately $120 million, less than the loss from operations.

A Stocktwits user opined that the stock will likely drop to a trading range of $2 to $3 if the negative trend continues.

OSCR stock is up by over 3% this year but down by about 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)