Advertisement|Remove ads.

OSCR Stock Snaps 6-Day Slide Ahead Of Q4 Results: Can The Rebound Survive Post-ACA Subsidy Fears?

- The stock posted its best session in nearly a month as investors looked ahead to quarterly results.

- Wall Street expects quarter-on-quarter revenue growth, while losses are projected to widen.

- The company has said previously that it remains confident of returning to profitability in 2026.

Shares of Oscar Health, Inc. (OSCR) snapped a six-day losing streak on Monday as investors looked ahead to quarterly results expected to show steady revenue growth but widening losses.

OSCR stock logged its best session in nearly a month on Monday to end at $12.66 and edged 2% higher in after-hours trading.

What Wall Street Expects From OSCR’s Q4 Print

According to Koyfin estimates, Oscar is expected to report quarter-on-quarter revenue growth, with fourth-quarter (Q4) revenue at $3.12 billion, up from nearly $2.99 billion in the prior quarter.

However, losses are expected to widen. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss is projected to balloon to $217.8 million from $101.5 a year earlier. Earnings before interest and taxes (EBIT) loss is expected to widen to $234.7 million from $129.3 million, while GAAP loss per share is forecast at $0.86 per share, compared with a loss per share of $0.53 per share previously.

OSCR stock carries a consensus 'Hold' rating, according to Koyfin. Of the 10 analysts covering the company, one rates it 'Strong Buy', none rate it 'Buy', six have 'Hold' ratings, two rate it 'Sell', and one rates it 'Strong Sell.'

Brokerage Views On OSCR Stock

Last month, UBS upgraded Oscar to 'Neutral' from 'Sell' and raised its price target to $17 from $12, saying exchange enrollment has held up better than feared despite the expiration of enhanced premium subsidies. UBS added that the shares appear fairly valued at current levels.

Around the same time, Barclays upgraded Oscar to 'Equal Weight' from 'Underweight' with an $18 price target. The firm said managed care stocks could benefit in 2026 from margin expansion and a rotation away from AI-linked stocks, adding that the market may be over-discounting the negative impact of expiring subsidies on Oscar.

More bullish commentary came earlier from Piper Sandler, which upgraded Oscar to 'Overweight' in November and raised its price target to $25 following a deep dive into pricing, benefit design, and broker strategy in Miami-Dade County. Piper said Oscar could grow market share and improve profitability even if enhanced subsidies expire, and described the calendar year 2027 adjusted EBITDA of $404 million as a downside floor.

Meanwhile, Jefferies maintained an 'Underperform' rating in December with a $12 price target, warning of elevated medical loss ratio risk tied to special enrollment periods, particularly in Georgia. Stephens, which initiated coverage in the same month with an 'Equal Weight' rating and a $17 target, described Oscar’s pure-play exposure to Affordable Care Act (ACA) exchanges as a “two-way street” that supports profitability initiatives but also adds uncertainty to longer-term growth.

ACA Enrollment Trends Remain A Key Overhang

Oscar’s earnings come as ACA enrollment shows early signs of cooling. Data from the Centers for Medicare and Medicaid Services showed 2026 marketplace enrollment at about 22.8 million, down from 24.3 million the prior year, following the lapse of enhanced premium subsidies that had been in place since 2021.

The subsidies had lifted total enrollment to above 24 million by 2025, after spending 11 million to 12 million from 2015 to 2021.

However, on its November earnings call, Oscar said it was confident it could expand margins and return to profitability in 2026, citing disciplined pricing and geographic expansion. In the third quarter, Oscar Health reported a smaller-than-expected loss with GAAP EPS of $0.53 versus consensus $0.58, even as revenue of $2.99 billion came in below estimates of $3.08 billion.

How Did Stocktwits Users React?

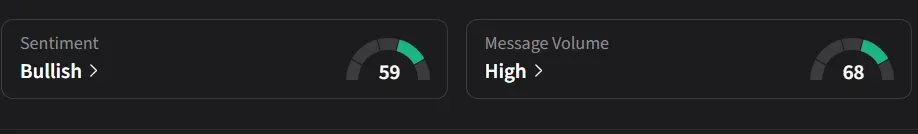

On Stocktwits, retail sentiment for Oscar Health was ‘bullish’ amid ‘high’ message volume.

One user noted that “The company has a history of surpassing EPS expectations 75% of the time over the past year.”

Another user said, “OSCR feels priced for bad news already. Expectations are low, sentiment is washed out, and management has been executing quietly. Doesn’t need a blowout — a clean beat + solid guidance is enough to re-rate this. Staying long and letting earnings do the talking. “

OSCR stock has declined 14% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)