Advertisement|Remove ads.

Otter Tail Posts Mixed Q4 Despite Record Earnings: Guidance Beats Estimates, But Retail's Bearish

Otter Tail Corp. (OTTR) posted mixed fourth-quarter (Q4) results despite delivering record earnings during the period. The company’s fiscal year 2025 guidance also came out ahead of analyst estimates.

Otter Tail’s fourth-quarter earnings per share (EPS) stood at $1.30, comfortably ahead of an estimated $1.24, according to Stocktwits data.

The low-cost electric utility’s fourth-quarter revenue stood at $303 million, missing estimates of $322 million, and falling from $314 million from the same period a year ago.

For the full fiscal year 2024, Otter’s EPS stood at $7.17, ahead of the expected $7.11.

Its revenue for the year stood at $1.33 billion, slightly lower than an estimated $1.35 billion and falling from $1.35 billion in 2023.

“Our Manufacturing segment continues to navigate softened end market demand, and we have taken action to mitigate the impact of lower sales volumes on earnings,” said President and CEO Chuck MacFarlane.

Despite the revenue decline and missing analyst estimates, MacFarlane noted that the long-term fundamentals of the company were “intact.”

The company also sounded optimistic about the fiscal year 2025, with its guidance of EPS being in the $5.68 to $6.08 range, while the consensus estimate is at $5.62, according to The Fly.

Assuming that Otter posts an EPS of $6.08 in FY25, it would still be lower by more than 15% compared to FY24.

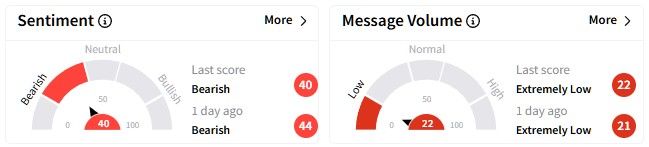

On Stocktwits, retail sentiment around the Otter Tail stock was in the ‘ bearish’ (40/100) territory, worsening from a day ago.

Otter’s stock has had a challenging few months – it has fallen by nearly 13% over the past six months, while its one-year performance is slightly worse, with a decline of nearly 13.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)