Advertisement|Remove ads.

Buffett Effect: Most Occidental Retail Traders Admit Oracle Of Omaha Has 'Significant’ Effect On Their Decisions

Occidental Petroleum’s (OXY) retail investors are following Warren Buffett-led Berkshire Hathaway’s lead for trades in the oil and gas producer’s stock.

The energy firm’s shares have gained 10.6% over the past week after Warren Buffett’s Berkshire Hathaway boosted its stake in the company. The company also topped fourth-quarter earnings estimates.

Berkshire bought 763,017 shares of Occidental for $35.7 million last week, boosting its stake to 28.2%.

Occidental is now the sixth-biggest holding of Berkshire, just behind oil and gas major Chevron.

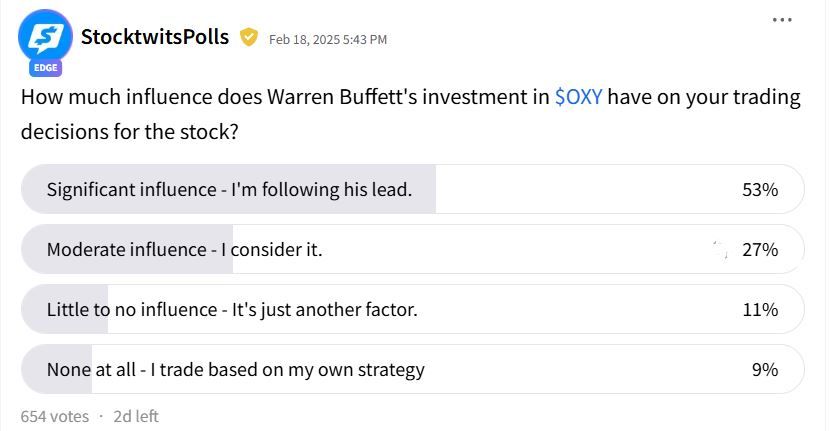

In a Stocktwits poll, 53% of more than 650 respondents said Buffett’s trades have a “significant influence” on their decisions, while 27% said they are moderately influenced.

Recent discussions on Stocktwits highlight how the billionaire investor’s backing influences retail sentiment.

One trader suggested that investors in high-flying stocks like Intel and Palantir should consider rotating into Occidental Petroleum, citing its steady performance, strong free cash flow, and Buffett’s continued support as key advantages.

Another argued that shorting OXY made little sense, especially when its earnings were solid, valuation remained low, and it had the backing of a "beloved investor born in the USA."

Over the past seven days, message volume on Stocktwits surrounding the stock has jumped 300%.

Berkshire also has warrants to buy 83.9 million Occidental shares at a strike price of $59.62 per share.

The conglomerate obtained the warrants after its $10 billion investment into the company, which helped Occidental complete its debt-laden 2019 purchase of Anadarko Petroleum.

As of Dec. 31, the company had a long-term net debt of $24.98 billion after it took on more debt to complete its $12 billion acquisition of CrownRock last year.

Berkshire had received regulatory approval to buy up to 50% of the company in 2022. However, Buffett clarified that Berkshire did not intend to buy the company.

Occidental stock trades nearly 27% below its all-time highs amid volatility in commodity prices.

The company topped fourth-quarter profit estimates on Tuesday, aided by robust production growth.

According to FinChat data, Wall Street’s analysts have set an average price target of $61.70 for the stock. The target implies an 18.4% upside to the stock’s last close.

Its forward price-to-earnings ratio, a metric that indicates future profitability, stands at 14.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)