Advertisement|Remove ads.

Pacific Gas & Electric Stock Dips On Q4 Revenue Miss Despite Hiking Full-Year Guidance: Retail Sentiment Surges

Shares of Pacific Gas & Electric (PG&E) Corp. (PCG) fell over 1% in morning trade on Monday after the company’s fourth-quarter (Q4) revenue missed Wall Street estimates, while earnings were in line.

PG&E’s fourth-quarter earnings per share (EPS) came in at $0.31, meeting analyst estimates, according to Stocktwits data.

However, its revenue of $6.63 billion during the quarter was considerably below the estimated $7.22 billion.

The company raised its earnings guidance for the fiscal year 2025 – it expects EPS in the range of $1.48 and $1.52, compared to a previous range of $1.47 and $1.51. Data from FinChat shows the consensus estimate is $1.49.

PG&E’s operating cash flow surged from $4.7 billion in 2023 to $8 billion in 2024.

"In 2024, we continued progress in ways that matter to both customers and investors. We delivered energy safely-our system has never been safer, and we are working to make it even safer. We stabilized combined gas and electric bills for residential customers,” PG&E said.

Ahead of earnings, analysts at JPMorgan initiated their coverage of PG&E with an ‘Overweight’ rating and a price target of $22. Bank of America (BofA) Securities hiked its price target to bring it to $22, from $21. This implies an upside of nearly 44% from current levels.

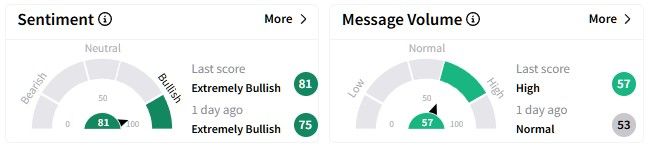

Retail sentiment on Stocktwits around the PG&E stock soared, hovering in the ‘extremely bullish’ (81/100) territory, while message volume surged to enter the ‘high’ levels.

Despite Thursday morning’s decline, one user wondered if the PG&E stock could hit $20 today.

PG&E stock price has been on a downtrend recently, falling over 13% in the past six months.

However, its one-year performance has been relatively better, with a decline of 2.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)