Advertisement|Remove ads.

Palantir Retail Investors Brace For Strong Gains As Wedbush Reaffirms ‘Top Names To Own’ Status After NATO AI Contract

Palantir Technologies, Inc. (PLTR) stock jumped on Monday, outperforming the broader market and the tech sector, following an award of a North Atlantic Treaty Organization (NATO) contract.

The contract provides for NATO’s Communications and Information Agency to acquire Palantir’s Maven Smart System for artificial intelligence (AI)-enabled battlefield operations.

Wedbush analyst Daniel Ives said this was another win for CEO Alex Karp as more federal customers turn to Palantir for improved AI capabilities in the military.

While noting that Palantir stock took a beating recently from the Department of Defense’s spending cuts, the analyst said the company’s unique software approach will help it to capitalize on the growing demand for AI implementation.

He added that this, along with the capability to handle the most sensitive workloads, puts the company in a strong position to gain further market share in the U.S. federal market.

Ives said, “We believe this deal represents an additional tailwind for PLTR with AI initiatives across both the US and European governments accelerating.”

Wedbush said Palantir remained one of its top names to own in 2025. The firm has an ‘Outperform’ rating and a $120 price target for Palantir stock.

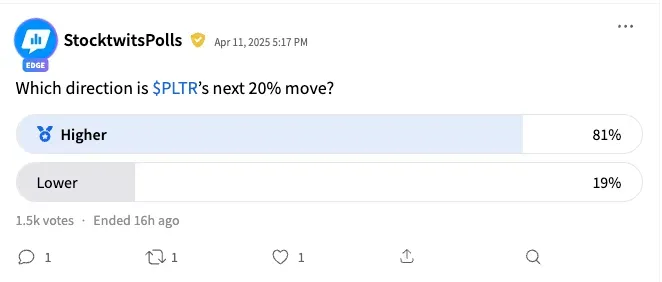

A Stocktwits poll that received responses from 1,500 users showed that 81% of the respondents expect the next 20% move in Palantir stock will be to the upside.

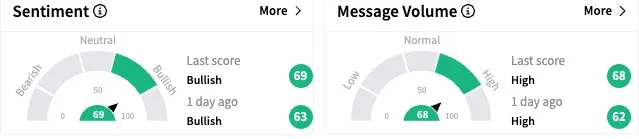

On Stocktwits, sentiment toward Palantir stock remained ‘bullish’ (69/100), with the optimism accompanied by ‘high’ message volume.

A bullish watcher was bracing for the Palantir stock to hit $220 by the end of the year.

Another user said the company will benefit from the dollar weakness as it exports services to Europe.

Palantir stock ended Monday’s session up 4.60% at $92.62. The stock is up more than 22% this year and is currently the eighth best-performing S&P 500 stock for the year-to-date period.

The company will report its first-quarter earnings after the market closes on May 5.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)