Advertisement|Remove ads.

Paramount Stock Falls After Edgar Bronfman Jr. Drops Out And Paves Way For Skydance: Retail Investors On The Fence

Seagram Co. heir Edgar Bronfman Jr. dropped out of his bid to acquire beleaguered Paramount Global late on Monday following which the deal agreed with Skydance Media will go ahead. The firm believes the transaction is expected to conclude in the first half of 2025.

Bronfman Jr., who made a last-minute entry into the bid for Paramount, reportedly said his group continues to believe that Paramount Global is an extraordinary company, with an unrivaled collection of marquee brands, assets and people. “While there may have been differences, we believe that everyone involved in the sale process is united in the belief that Paramount’s best days are ahead,” he said in a statement.

With Bronfman out of the picture, Paramount said the "Go-Shop" period has concluded with respect to all parties. Paramount’s agreement with Skydance had triggered a 45-day Go-Shop period during which other bidders could come forward with better offers.

Paramount said that during the go-shop period, representatives of the Special Committee contacted more than 50 third parties to determine whether they had an interest in making a proposal to acquire the firm.

Bronfman had reportedly come in toward the end of the period’s expiry, submitting a $4.3 billion that included an offer to acquire the Redstone family holding company National Amusements for about $2.4 billion. The Seagram-heir later improved the offer to $6 billion.

According to CNBC, Bronfman was unable to shore up the equity financing package required for his bid with few of his key equity partners on the deal dropping out at the eleventh hour.

Charles E. Phillips, Jr., Chair of the Special Committee of Paramount Global said in a statement that having thoroughly explored actionable opportunities for Paramount over nearly eight months, the Special Committee continues to believe that the transaction with Skydance delivers immediate value and the potential for continued participation in value creation in a rapidly evolving industry landscape.

According to Bloomberg, Bronfman offered to acquire Paramount shares from its current investors at a slightly higher price, albeit in a lower amount than what Skydance’s David Ellison offered.

At the same time, Ellison’s plans involved merging Skydance into Paramount at a $4.75 billion valuation, the report said. Bronfman also reportedly highlighted that the Skydance valuation was high and was dilutive to shareholders.

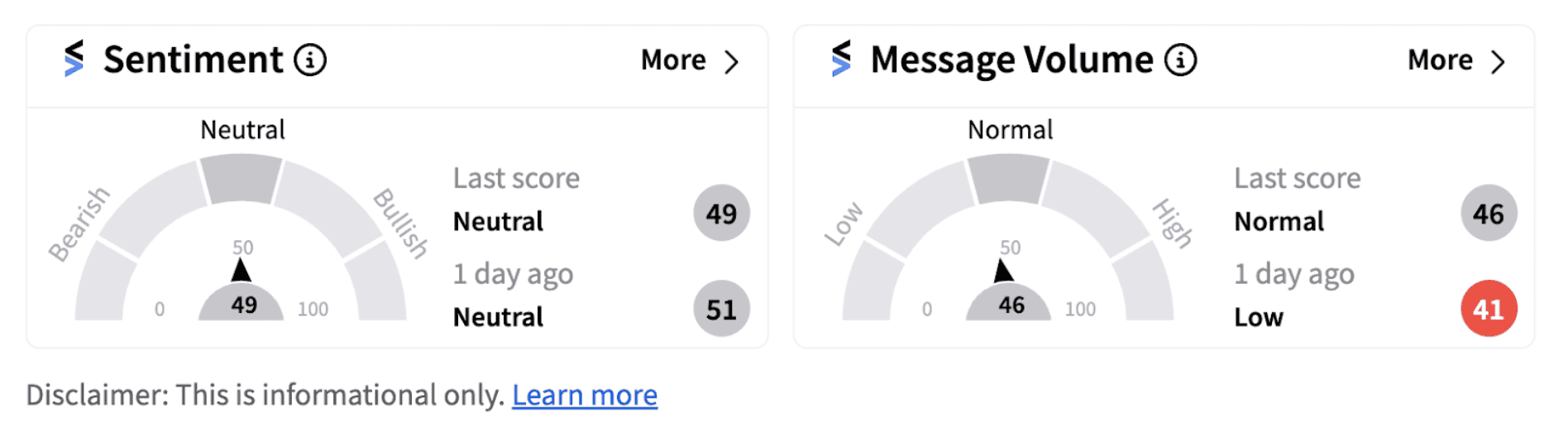

Following the announcement, shares of Paramount were trading nearly 4% lower in Tuesday’s pre-market trading. Although Wall Street was unhappy with the development, retail investors on Stocktwits remained on the sidelines, with the sentiment meter continuing to trend in ‘neutral’ territory (49/100).

Some Stocktwits users are expressing skepticism about the deal passing the necessary regulatory checks.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)