Advertisement|Remove ads.

Paranovus Stock Jumps After 18,000% Revenue Surge In First Half — Traders See A Path Back Toward $1 Nasdaq Target

- Interim results show the company returning to profitability, with gross margin expanding sharply after exiting legacy loss-making operations.

- Strong performance from its U.S. e-commerce and TikTok-focused units drove a surge in operating leverage.

- The company also filed a $200 million shelf registration last month.

Shares of Paranovus Entertainment Technology (PAVS) jumped 22% on Friday after the company reported an extraordinary jump in revenue and a return to profitability for the six months ended Sept. 30, 2025.

The stock gained to $0.038 after four consecutive sessions of losses.

Earnings Review

The company reported $12.41 million in revenue, up from $68,454 a year earlier, marking an 18,037% year-over-year surge driven by its U.S. e-commerce and TikTok-focused service units. Net profit attributable to the company reached $97,708, compared with a $412,181 loss in the prior-year interim period.

Gross profit rose to $2.48 million, up from $9,276, reflecting significant margin expansion and the company’s exit from “legacy loss-incurring” operations.

"Our interim performance showcases revenue momentum and accelerating profit formation, highlighting fast transitional growth cycle of the company,” CEO Xiaoyue Zhang said in a statement.

Growth Drivers

The revenue jump was fueled by strong performance from U.S. subsidiaries Bomie Wookoo Inc., Wookoo LLC and Bomie US LLC, which operate in e-commerce product sales and TikTok-related digital branding, consulting and advertising production.

The company said the interim results demonstrate increasing operating leverage following its acquisition of Bomie Wookoo in March and its prior wind-down of legacy e-commerce, internet information, advertising and automobile segments in September 2023. It also ceased its automobile sales business in July 2024.

Nasdaq Compliance Status

In July, Nasdaq notified Paranovus that its shares had traded below $1 for 30 consecutive business days, putting the company out of compliance with listing rules.

Paranovus has until Jan. 7, 2026 to regain compliance by maintaining a closing bid of at least $1 for 10 consecutive sessions.

If the company does not regain compliance by that date, it may receive a second 180-day extension, provided it meets all other listing requirements and notifies Nasdaq of its intention to cure the deficiency, potentially through a reverse stock split.

Stocktwits Traders See Path Back Toward $1

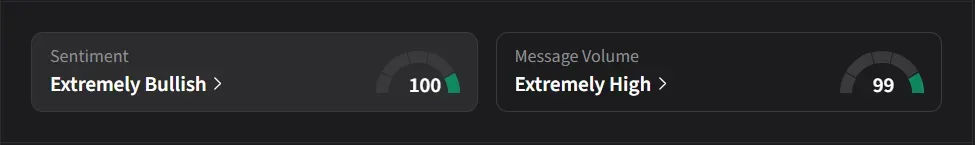

On Stocktwits, retail sentiment for Paranovus was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user remained optimistic about the company regaining Nasdaq compliance, noting that a move back toward $1 remained possible.

Another user said, “With this interim numbers, we should lift off in the next hours.”

Paranovus’ stock has plunged 97% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)