Advertisement|Remove ads.

Pasithea Therapeutics Stock Rockets To Best Day In 4 Years On Massive Share Offering Amid ALS Drug Momentum

- Shares surged as investors reacted to a large equity offering combined with renewed optimism around Pasithea’s expanding clinical programs.

- A $1 million ALS Association grant boosted excitement around PAS-004’s first ALS trial.

- Strong early-stage data across multiple studies and rising retail chatter added to the day’s trading.

Pasithea Therapeutics recorded its strongest trading session in four years after unveiling a massive equity offering amid growing clinical momentum for PAS-004, its experimental therapy now advancing toward ALS studies alongside ongoing work in solid tumors and neurofibromatosis.

The stock surged 117% on Wednesday to a nearly seven-month high, and added 11% after hours.

Pasithea Unveils Big Equity Raise

The company announced a share offering of up to 75 million shares of common stock at an assumed price of $0.80 per share, alongside up to 75 million pre-funded warrants priced at $0.799 per warrant. Each pre-funded warrant is exercisable for one share at $0.001 and becomes active immediately, with the overall offering running on a reasonable best-efforts basis through Dec. 31. The company noted that it will not seek an exchange listing for the pre-funded warrants.

ALS Funding Drives Renewed Attention

The surge in stock price also followed the ALS Association's award of about $1 million through its Hoffman ALS Clinical Trial Award to support the first study of PAS-004 in people living with ALS. The grant will fund research into the drug’s safety, efficacy, and tolerability as it moves the lead therapy into a new neurological disease.

Pasithea Chairman Lawrence Steinman said the award enables the start of the inaugural ALS trial for PAS-004, noting that the treatment targets a key molecule involved in motor neuron disease and has shown promising results in the gold-standard SOD mouse model.

PAS-004 Advances Across Multiple Trials

PAS-004 also continued to progress across additional programs. In Cohort 7 of the ongoing Phase 1 study in MAPK-driven advanced solid tumors, PAS-004 remained safe and well tolerated with no dose-limiting toxicities, supporting the Safety Review Committee’s recommendation to proceed to Cohort 8.

Interim data showed inhibition of the drug’s biological target, early signs of tumor response in BRAF-mutated melanoma patients, and continued disease stability in others. Pasithea separately released data from its tablet formulation, showing dose-proportional pharmacokinetics and higher exposure levels than the capsule version. The company also activated a new U.S. clinical site at the University of Alabama at Birmingham for its neurofibromatosis Type 1 program.

Stocktwits Traders Cheer The Surge

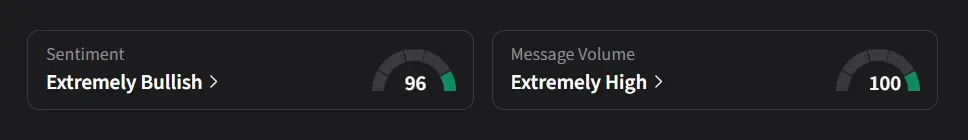

On Stocktwits, retail sentiment for Pasithea was ‘extremely bullish’ amid a 1,385% surge in 24-hour message volume.

One user said, “in at $1.20. Making Thanksgiving pies. Jumped to $1.50, rolled out more dough thinking it’d go higher, and missed it. Praying it runs again Friday!!”

Another user said, “what a Battle , what a vola... Longs won here already imho.”

Pasithea’s stock has declined 66% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)