Advertisement|Remove ads.

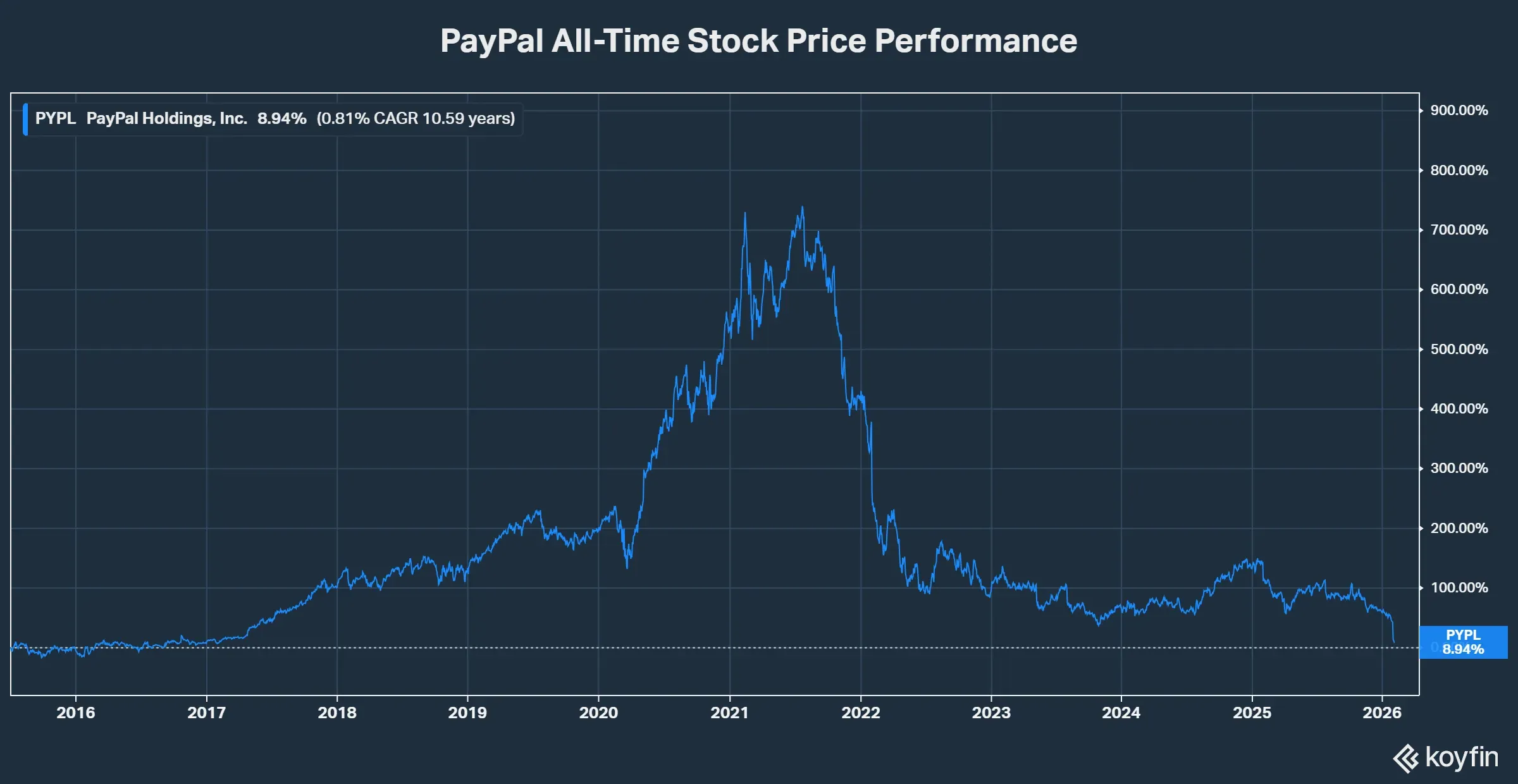

PayPal Stock Is Almost Back To Where It Started — Now Just 9% Above 2015 IPO Price

- PayPal slid for a tenth straight session, trading near its 2015 post-spin levels after a Q4 earnings miss.

- The Q4 earnings miss triggered a record one-day drop of more than 20% earlier this week.

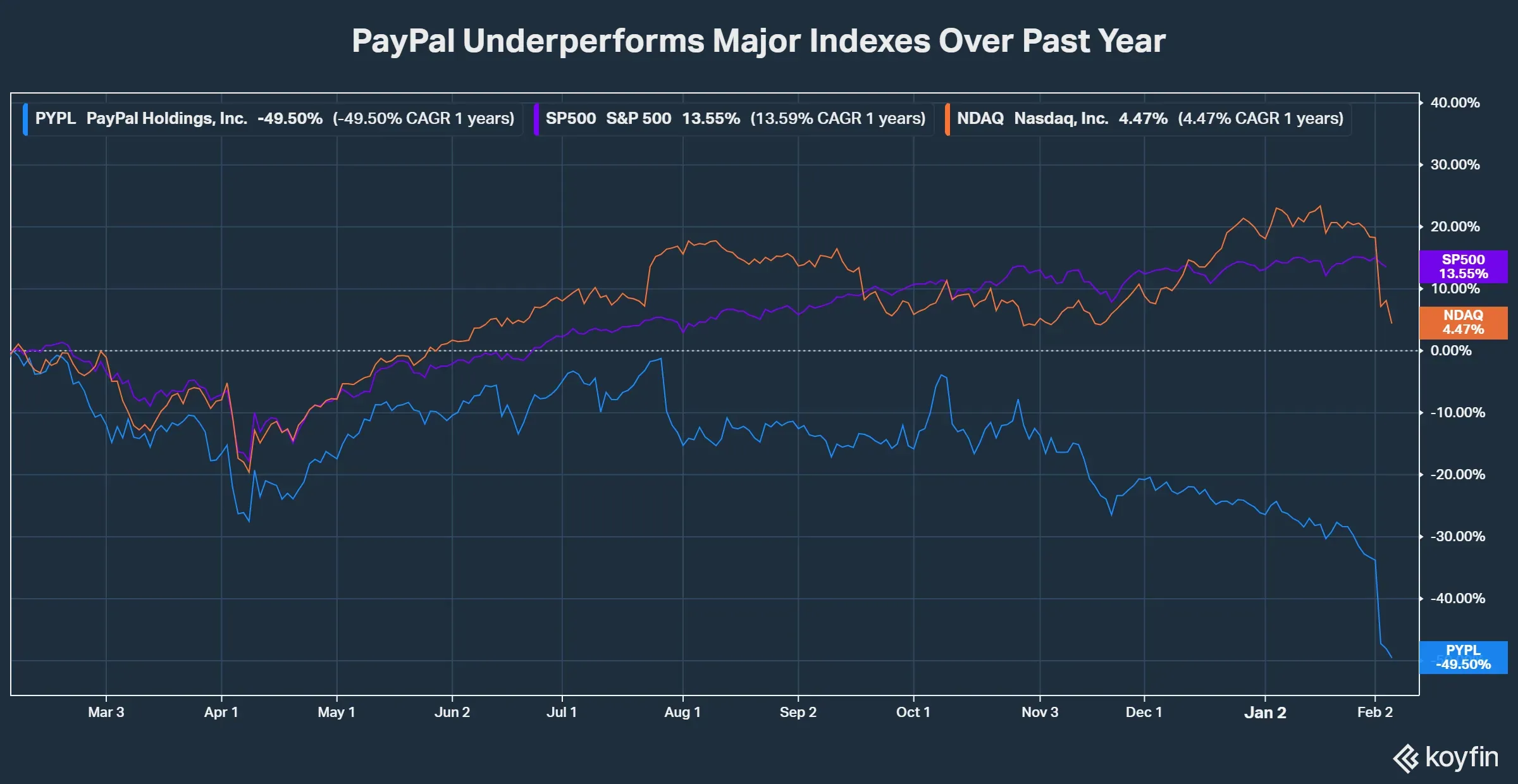

- The stock has underperformed major indexes, down about 50% over the past year versus gains on the S&P 500 and the Nasdaq.

Shares of PayPal Holdings slid again on Thursday, extending a losing streak to 10 sessions and leaving the stock trading near levels last seen shortly after its 2015 return to public markets. At around $39.9, PayPal shares are now roughly 9% above their post-spin trading price.

PayPal returned to public markets in July 2015 after being spun off from eBay, trading in the low-$40 range. The company had previously been listed on Nasdaq before being acquired by eBay in 2002.

PYPL Q4 Miss Triggers Record One-Day Drop

The steepest move came earlier in the week, when PayPal shares fell more than 20%, marking the largest single-day decline ever after the release of fourth-quarter (Q4) results that missed Wall Street expectations. PayPal reported Q4 revenue of $8.68 billion, up 4% year over year, but below expectations of $8.79 billion. The company also posted adjusted earnings per share of $1.23, missing estimates of $1.29.

Alongside the earnings report, PayPal said HP boss Enrique Lores will become CEO effective March 1, replacing Alex Chriss. The company also expects adjusted earnings per share (EPS) of $1.33 in the first quarter of 2026, compared with expectations of $1.38.

Over the past 12 months, PayPal shares have plunged 50%, while the S&P 500 is up 14% and the Nasdaq is up about 4%.

Rare Public Criticism

The turmoil has drawn unusual criticism from current and former executives in the payments and technology space. Opendoor CEO Kaz Nejatian said PayPal spent years prioritizing growth in its Braintree unit at the expense of its core branded checkout product, a strategy he argued damaged the platform’s long-term competitiveness.

Former PayPal president David Marcus also weighed in, questioning the decision to appoint a hardware-industry executive to lead a payments network and highlighting the importance of transaction economics and network effects in PayPal’s business.

Gary Black Calls PayPal ‘Expensive For Sellers’

Following the selloff, Gary Black shared his view on PayPal’s competitive positioning, saying that the company is “very expensive for sellers vs other online payment providers.”

Black said PayPal generally charges 3.5% per transaction, compared with 1.9% for Venmo, 1.5%–2.2% for Visa, 2.9% for Square, and 2.5%–3.25% for American Express. He added that buy-now-pay-later (BNPL) providers Affirm and Klarna charge sellers around 5%–6%. He also said PayPal remains one of his “least-liked” online payment providers, citing its quarterly results and leadership change.

Wall Street Cuts PYPL Price Targets

Wall Street firms lowered price targets after the earnings release. Bank of America reduced its target to $48 from $68 and kept a ‘Neutral’ rating, saying investors are “questioning whether it is a management or a PayPal problem.” TD Cowen cut its target to $48 from $65 and said shares are likely to remain adrift in the near term.

JPMorgan lowered its target to $46 from $70 and maintained a ‘Neutral’ rating, saying the results supported concerns about PayPal’s ability to maintain share. Goldman Sachs cut its target to $41 from $64 and reiterated a ‘Neutral’ rating, saying the company’s acknowledgement of share losses in key markets confirmed existing concerns.

According to Koyfin, the average 12-month price target is $53.28, implying a 34% upside from the current price. Targets range from $34 on the low end to $100 on the high end. Of the 45 analysts covering the stock, 31 rate it ‘Hold’, 8 rate it ‘Buy’, 2 rate it ‘Strong Buy’, and 4 rate it ‘Sell’.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for PayPal was ‘extremely bullish’ amid ‘extremely high’ message volume. Activity has also surged nearly 80% over the past year.

One trader said the market appeared to be sliding broadly, with losses in big names like Amazon raising concerns that AI enthusiasm may be fading. The user said PayPal could hold if it finds support in the mid-to-low $30s and likened the setup to 2022, when the ProShares UltraPro QQQ ETF fell for months.

Meanwhile, another user said, “When the RSI [relative strength index] hits 3 on the daily, it will be a value play.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)