Advertisement|Remove ads.

PayPal Stock Plummets After Mixed Earnings, Yet Retail Investors Stay Bullish

Shares of PayPal Holdings Inc. ($PYPL) dropped as much as 7% in premarket trading Tuesday, following the release of third-quarter earnings.

Although the payments company exceeded Wall Street’s profit expectations, revenue came in just below forecasts, creating some investor unease.

For the third quarter, PayPal posted earnings per share (EPS) of $1.20, surpassing the consensus estimate of $1.07.

However, revenue slightly missed the mark, totaling $7.85 billion against the anticipated $7.88 billion.

This is the first earnings release since CEO Alex Chriss, who joined the company during a downturn last September, completed his first year at the company.

In the quarter ended Sept. 30, PayPal reported a total payment volume of $422.6 billion, up 9% from the same period last year — a positive indication of how digital payments are faring in the broader economy.

The company also saw a modest 1% increase in active accounts, bringing its user base to 432 million.

For fiscal 2024, PayPal said it’s focusing on “profitable growth.” The company now expects adjusted earnings per share to grow by a ‘high-teen’ percentage (generally between 17% and 19%), up from an earlier estimate of ‘low to mid-teen’ growth (typically between 13% and 16%).

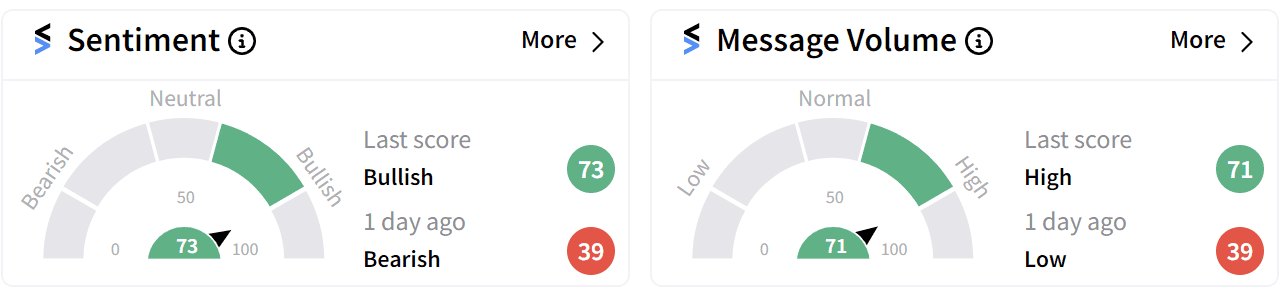

Retail sentiment on Stocktwits has flipped into ‘bullish’ territory post-earnings from ‘bearish’ a day ago accompanied by ‘high’ message volume.

The stock has risen 31% in 2024 as the company shifts its focus to high-margin volume.

For updates and corrections email newsroom@stocktwits.com.

Read more: Robinhood Stock Hits 4-Year High On Election Trading Launch, But Retail's Far From Excited

/filters:format(webp)https://news.stocktwits-cdn.com/gsk_resized_jpg_00efc66e77.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_GE_Aerospace_resized_a883195e2c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_threads_resized_jpg_e588a33209.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/pulses-fao.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Albemarle_jpg_770d10f547.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)