Advertisement|Remove ads.

Paytm Shares Rise Despite Bigger Q4 Net Loss: SEBI RA Harika Enjamuri Warns Of Bearish Signals

Shares of Paytm (One 97 Communications Ltd) showed some signs of sequential improvement in the fourth-quarter (Q4) of FY25, but the company remains under pressure, according to SEBI-registered Research Analyst Harika Enjamuri.

Paytm shares rose 8.71% to ₹885.8 at the time of writing.

Revenue for the quarter rose to ₹1,599 crore from ₹1,492 crore in Q4FY25, while operating loss narrowed to ₹81 crore from ₹208 crore, improving operating profit margin (OPM) to -5% from -14%.

However, the net loss widened to ₹580 crore from ₹205 crore a year earlier, primarily due to a sharp fall in “other income.”

For the full fiscal year, revenue fell to ₹5,505 crore from ₹7,661 crore in FY24, while operating loss increased to ₹1,481 crore from ₹1,038 crore.

Net loss narrowed to ₹789 crore from ₹1,476 crore, driven by a substantial rise in other income to ₹1,365 crore from ₹307 crore.

Despite some operational improvements, Paytm continues to struggle with cost control and profitability, Enjamuri noted.

From a technical perspective, Enjamuri sees a cautious to bearish outlook for the stock.

The stock tumbled nearly 6% on Tuesday,, closing at ₹814.85, just below its 100-day exponential moving average (EMA) of ₹834.07, suggesting immediate weakness.

The Relative Strength Index (RSI) at 46.52 is trending downward, indicating diminishing bullish momentum.

If the selling pressure persists, the stock could fall to the ₹784–₹760 support zone, Enjamuri added.

On the weekly chart, while the stock remains above key EMAs at ₹694.05 and ₹632.86, it is struggling to hold above ₹800.

Enjamuri suggests that unless Paytm regains the ₹834–₹850 range with strong volume support, it may face further downside pressure toward ₹796 and ₹760.

A reversal would require a bounce above ₹850, confirmed by bullish volume.

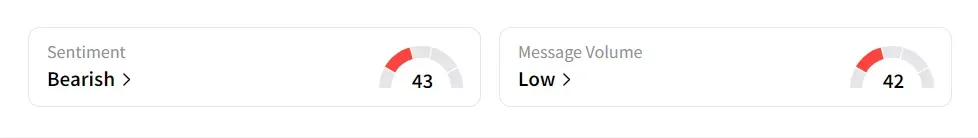

On Stocktwits, sentiment was described as ‘bearish’ amid ‘low’ message volume.

Shares of Paytm have fallen 10.3% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)