Advertisement|Remove ads.

PDD Holdings Stock Falls Amid USPS Parcel Ban On Small Packages From China, Regulatory Scrutiny: Retail’s Downbeat

ADR shares of PDD Holdings ($PDD), parent of retailer Temu, dropped more than 3% after United States Postal Service announced it would now accept inbound parcels from mainland China and Hong Kong shortly after announcing a ban, dragging down retail sentiment.

The USPS move came after the U.S. escalated its trade tariffs several countries including China and ended a custom provision that allowed the tax-free import of small value packages.

USPS has since reversed the ban without citing explicit reasons, except to say it was working with Customs and Border Protection for a process to minimize delivery disruptions, AP reported.

The ban would have also impacted other e-commerce majors including Alibaba ($BABA) and Amazon ($AMZN).

Separately, Temu may also face additional restrictions as reports emerged that the US was considering adding Chinese retailers Temu and Shein on the Department of Homeland Security's "forced labor" list. Both companies reportedly denied the use of forced labor.

A Temu spokesperson was quoted as saying by Fly.com,"Temu strictly prohibits the use of forced labor and enforces our Third-Party Code of Conduct, which bars all forms of involuntary labor. Sellers and business partners must ensure their own - and their suppliers' - full compliance with this code and relevant laws. Temu reserves the right to terminate any business relationship if a seller or partner fails to meet these standards.”

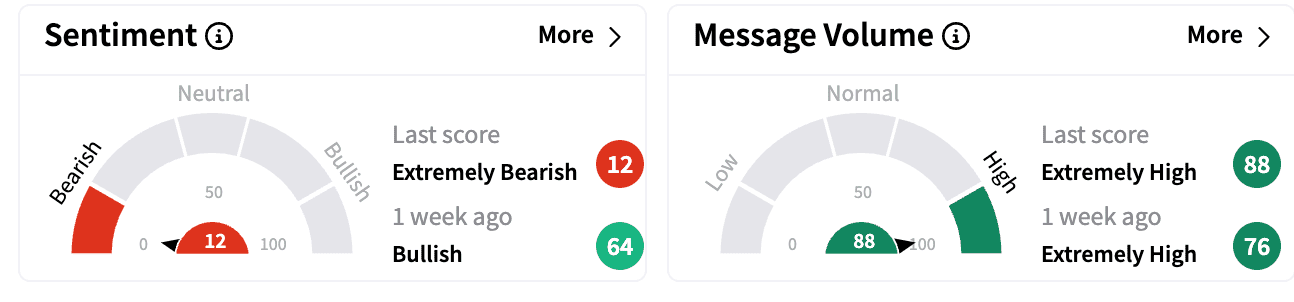

Sentiment on Stocktwits fell to ‘extremely bearish’ from ‘bullish’ a week ago. Message volumes were in the ‘high’ zone.

For the latest quarter, PDD Holdings posted $2.56 in earnings per share, below Wall Street estimates of $2.71.

PDD Holdings stock is up 13% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)